Brief Introduction:

Just as this author had addressed beginning of summer in an article regarding oil and the Ghost of the 1985, it appears oil is going to further its decline. But then again, everything is going to decline – courtesy of the Federal Reserve. It appears no matter what tricks or delays the elites use, a bust is always inevitable.

Yellen: Delussional

In December, the Fed led by Janet Yellen lifted rates for the first time in nearly a decade. College graduates that went to work on Wall Street during 2006 thus have never even been on the trading floor during a rate hike. So what could anyone expect?

Here are some of the points she made from her much awaited press conference (full transcript; 12/2015).

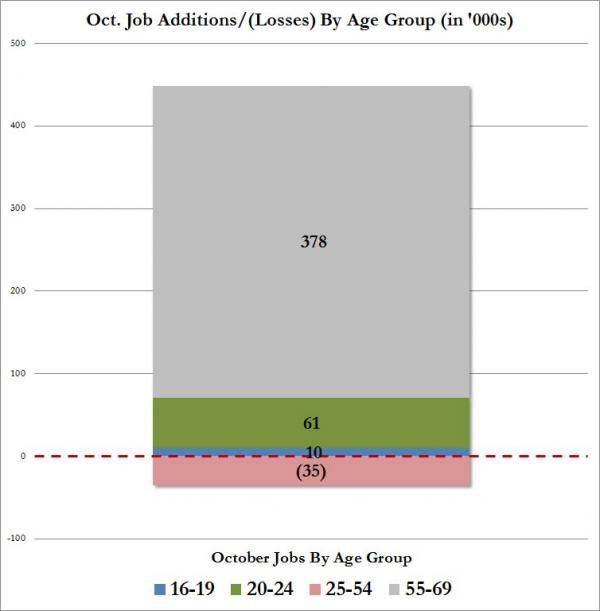

Point 1. “The labor market has clearly shown significant further improvement toward our objective of maximum employment…The unemployment rate, at 5 percent in November, is down 0.6 percentage point from the end of last year and is close to the median of FOMC participants’ estimates of its longer-run normal level,” said Yellen. If the Fed wanted maximum employment, the government could simply hire individuals to dig then refill ditches. What happened to achieving max productivity, not max employment? Flashback to take a look at the October 2015 Jobs from the BLS report to gauge employment quality:

It appears more than roughly 75% of the jobs went to individuals aged 55-69, while individuals 25-54 of age actually lost jobs. Also, the labor participation rate is at a 40 year low – thus lowering the percentage further.

Also important to note with the energy market all but on life support and significant major job layoffs from major oil companies such as BP, Halliburton (HAL), Chesapeake (CHK), Shell, and countless many small companies – how will this affect other markets. How will this affect oil states in the long term? These were high paying salaried jobs which are being put to rest and low paying hourly jobs replacing them through service sector and retail.

Leave A Comment