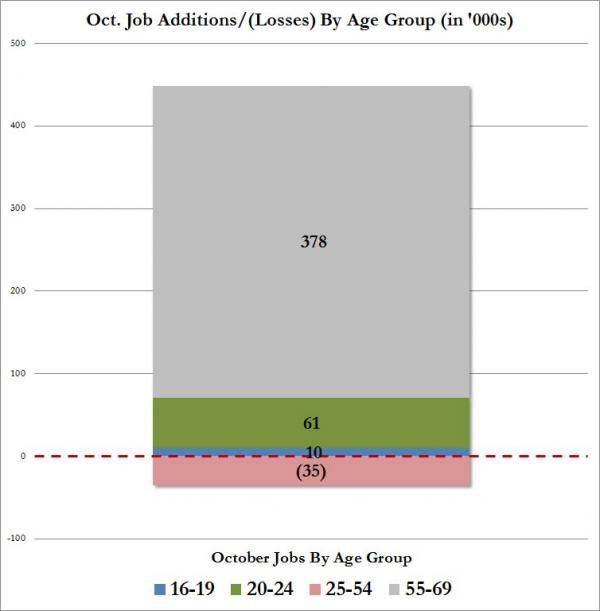

I have devoted many blog posts to the erosion of the middle class, for the specific reason that when the middle class–the layers of the economy between the Power Elites and landless laborers/state dependents–erodes away, the nation/empire is destabilized and descends

January 17, 2016