There is a great lyric in Won’t Get Fooled Again by The Who:

Then I’ll get on my knees and pray

We don’t get fooled again

Remember last week, when the price of silver spiked? On Thursday that week, the price was moving sideways around $14. Then around 5am (Arizona time), the price began to rise. Before 11am, it had hit $14.38. And then it was all over. The price went downhill from there, the rest of the day and all day Friday. It closed at $13.93.

The same thing happened this Thursday, with the move beginning at $13.81 at 6am. Before 10, it hit $14.17. As we did the previous week, we tweeted near the top. “Silver run up… fundamental or speculative?” The price slowly slipped the rest of the day, and at 5am on Friday began to drop sharply.

Extra bonus points: guess which morning price moves got the silver bugs’ knickers in a twist? The sharp rises or the sharp drop, around the same time of day?

Anyways at 5am on Friday, the price began to spike once again, reaching $14.13 before 7am. But it couldn’t hold. It closed the day, and the week, at $13.90.

Three spikes in two weeks, reaching $14.38, $14.20, and $14.13. We don’t tend to emphasize price charting, but as a technical indicator this does not seem bullish. We will address the fundamentals of silver and gold, below…

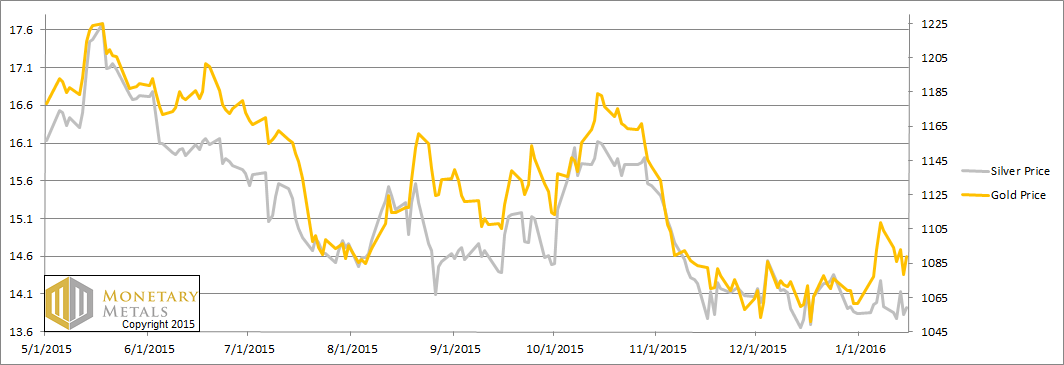

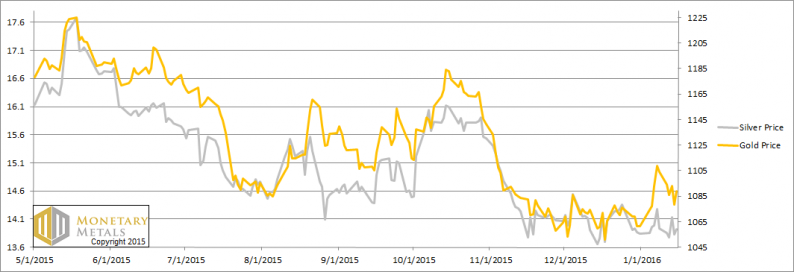

But first, here’s the graph of the metals’ prices.

The Prices of Gold and Silver

We are interested in the changing equilibrium created when some market participants are accumulating hoards and others are dishoarding. Of course, what makes it exciting is that speculators can (temporarily) exaggerate or fight against the trend. The speculators are often acting on rumors, technical analysis, or partial data about flows into or out of one corner of the market. That kind of information can’t tell them whether the globe, on net, is hoarding or dishoarding.

One could point out that gold does not, on net, go into or out of anything. Yes, that is true. But it can come out of hoards and into carry trades. That is what we study. The gold basis tells us about this dynamic.

Leave A Comment