Tomorrow is and important day for Metals and Miners. The FED announces their decision at 2:00 PM EST followed by a press conference at 2:30.

There are two potential cycle counts for gold. Our primary scenario foresees a decline into late July or early August. The alternate scenario will confirm a new bull market if gold closes the week above $1,300.

The HUI-GOLD ratio is coming to a head. A break from the pattern will determine which gold cycle to follow. We should see a decisive break soon.

-US DOLLAR- The Dollar remains weak and is doing little to confirm a low. Failure to break above the short-term trendline could lead to another drop.

-GOLD PRIMARY SCENARIO- Primary Scenario: The 6-Month Gold cycle made a double top and prices are working their way down into a 6-Month low. Prices should find support at the trendline completing the 4th daily cycle. Prices should bounce, and then rollover producing a failed daily cycle that finally breaks the 6-Month Cycle trendline.

-GOLD ALTERNATE SCENARIO- If Gold made an unorthodox 6-Month low, then prices are dropping into the first daily cycle low. In this scenario, prices would breakout above $1,300 and establish a new bull market. I will address entry strategies if gold closes the week above $1,300.

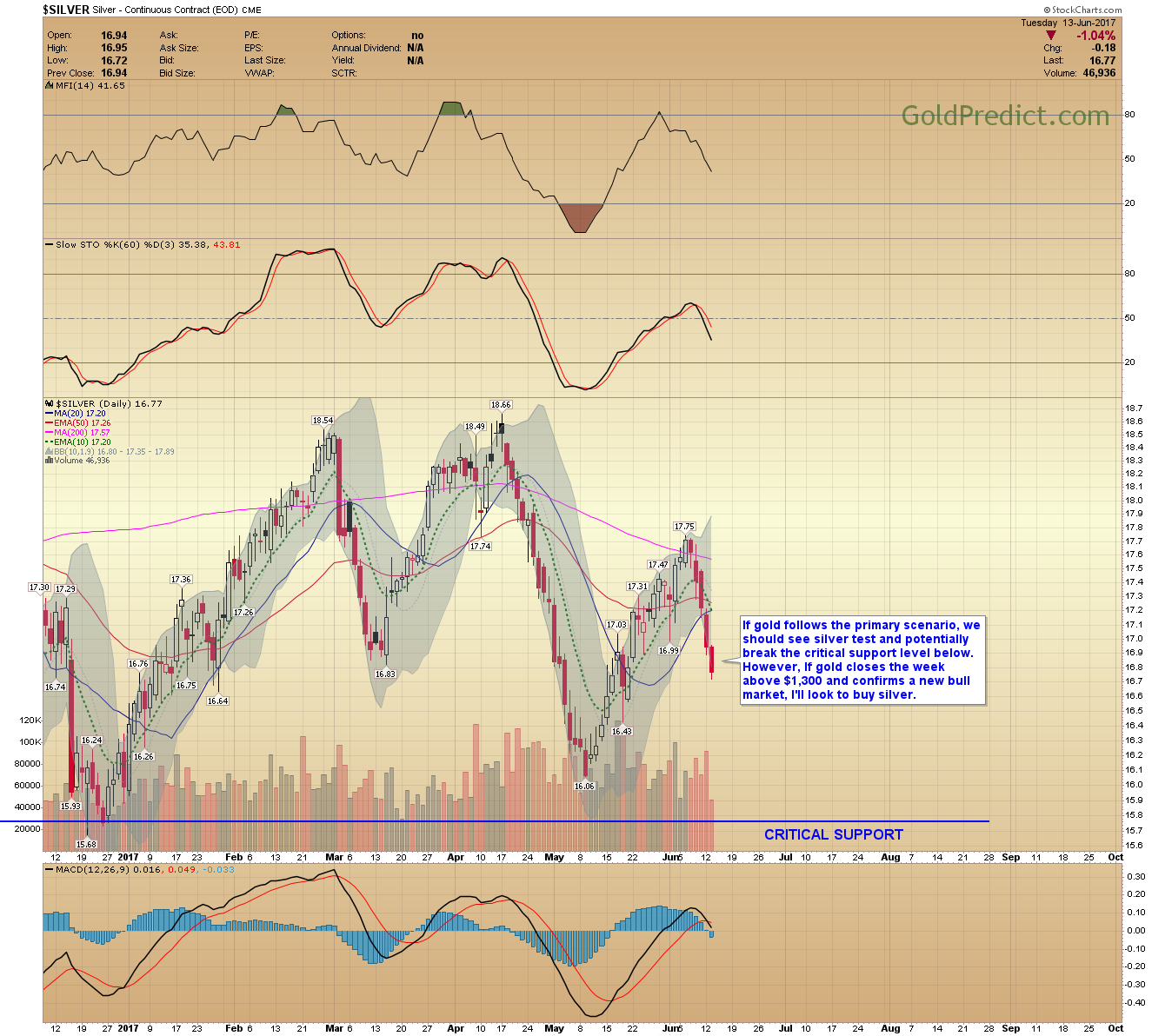

-SILVER- If gold follows the primary scenario, we should see silver test and potentially break the critical support level. However, If gold closes the week above $1,300 and confirms a new bull market, I’ll look to buy silver.

-HUI GOLD RATIO- This chart sums up the two scenarios in gold. Trading is challenging as the pattern narrows. If the pattern breaks lower, our primary scenario will be confirmed and miners/gold will breakdown. However, breaking sharply above the upper trendline and the 200-day MA would support the alternate scenario (May 6-Month low) and signal a breakout in miners.

-GDX- Miners rallied before the FED meeting. Prices are range bound and need to break free for a trending move to develop. I will buy miners if GDX breaks convincingly above the upper boundary.

Leave A Comment