Wall Street’s ‘Deep Freeze’ started a crucial warming-up phase, just after we observed that the projected break of the September and then the August lows would confirm bearishness thus bringing a bit of extreme capitulation, setting-up a group of short-sellers into weakness to be run-in.

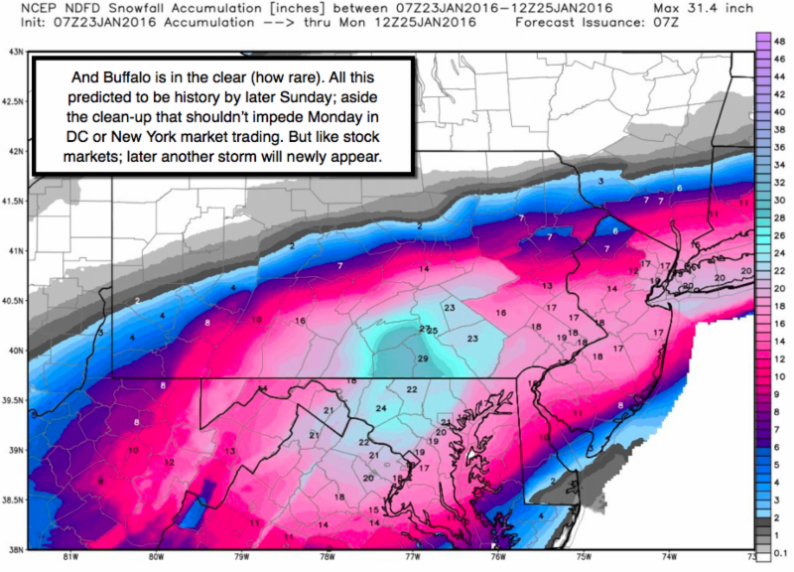

One cannot presume (hence the broad debate) that there won’t be another big storm in the wake of the initial deluge; just as the developing secondary low out there along the Atlantic Seaboard, is going to hit with a second wallop beyond the initial snowfall forecast we’ve shared all week (because it was important to all who could take the opportunity to either get out of the region early or batten down the hatches if needing to stay).

Of course the question is whether the upside, that we hoped would be fueled in large part by OIL, because with stocks like Amex, Starbucks and Boeing not in a position to be of help; this had to be led (as we said) by Oils, by Apple (AAPL), and of course short-covering in the most-shorted (former momentum) stocks.

All of it unfolded; and despite our being 50% short (indicating we preferred this move, after taking superb downside gains of 130 handles and then 200 handles on the March S&P 2065 short-sale guideline’s first 2 quarter-position portions), it is the type of move we desired to set-up the next phase of, yes, decline.

Concurrently back on Wednesday I remarked that everybody will debate this (of course they are); but no matter; it’s going to unfold with ‘ideally’ a snapback that goes above the ‘steep angle of attack’ of the accelerated declining-tops or downtrend line. Basically the acceleration was from below the indicated Nov. & Dec. lows concurrent with the entry into the projected ‘vacuum’ that I termed all the range between those lows and the preceding Aug./Sept. lows.

I believed that ‘vacuum’ would suck the life out of the market, and we weren’t at all disappointed. The believe that it would be fully filled is why we stayed short that second 25% with no stop; so as not to risk being taken out by a tiny bump. Once we filled the gap, and nominally broke the August lows; we indicated that we’d not get the exact low; but would not allow the S&P to get back to previous congestion zones without closing out another Quarter of the position. That’s as you know what we did (as far as the guideline; trading decisions are individuals at all time, and we do our best to sort of guide through the pattern, whether it’s a bias on our part or not). In this case it worked fine, as we’re near 40 handles above where we took that next chunk off the table; part of scaling-out profits.

While many pundits are so relieved to see the rally, and saying things like how wonderfully the week finished, after a miserable start; well all I say to that is it’s disingenuous or they don’t understand how the market works, even broadly. Of course it snapped-back; but no it doesn’t mean it’s out of the woods; nor does it mean (for most stocks) that value is restored to adequate low-risk investment levels, as should be distinguished from trading levels.

Even Energy or Oils, where we observed days ago value superficially was back are not risk-free. Not the overhanging default, dividend-cut or even a failure risk in smaller companies with debt, as Moody’s on Friday listed for over 100 of the firms. (Not much mention of that in the financial media; perhaps they didn’t see it or perhaps not wanting to ruffle the rally.) I’m glad it held together; as our call and bias has been for the Oil to lead (temporarily) the upward move; and that’s a reason I fretted that if we weren’t right on that, it would be because attention focused on the missed or dubious earnings reports from so many companies.

Technically – (and only because some technicians point to it and they’re wrong in my view) you have the typical chartist saying that ‘if’ you surmount 1880 that is the first threshold to start buying again (no). And if you get above 1960 S&P you buy more (no). And if you get to 1980-2000 S&P; you’re in the clear (no).

What they miss most importantly should be obvious: a) no significant bottom, even a ‘V’ bottom’, normally precedes higher without subsequently retreating in a new decline; which, b)can be a secondary test of the initial low; c) a double bottom or ‘W’ formation; or c) the beginnings of another wave that goes lower; with d) the potential (that part is very debatable) of moving deeper into the just barely-probed ‘no-man’s land’ as I termed it.

The latter is important; because with the S&P down over 10% from it’s highs (a lot more for sectors or individual stocks, and certainly for the broad averages), another phenomenon came-into-play that we’ve outlined before. That’s the dire straits of HFT or money managers who used ‘easy-money’ facilitated leverage to margin themselves not by the retail 50% level (none is what we suggested in the past year; although if we get a flat-out disaster crash; that becomes a fairly low-risk time to leverage, if one is going to at all, contrary to the mood that will prevail at such a time); but some of these guys use 4 or 5 to 1, or higher levels, in their daily ‘play’.

That means when they’re wrong it magnifies their losses; so that’s also why I’ve mentioned this many times in recent months. I was stunned that the market was already so rocky that it should have been obvious; and yet margin and leverage levels were essentially at record highs. Crazy. Recently it came-off a bit; but even now is fairly astounding as to how high the levels are.

Oh there’s two more parts to this (and I realize this weekend I’m focused more on technical aspects but that matters here): 1) the simplistic views of levels that make technicians more comfortable ‘buying’ more, are probably levels that they should be ‘selling’ more (if still heavily invested), or 2) if they played the trade to the long side, consider layering-back-on some short positions.

The other aspect of this was what I said on Wednesday: none of us will likely in any reliable way, be able to tell if this is just a ‘relief rally’, or a bottoming sort of process, for awhile. I suggested that ideally it would meander higher into early February probably at-best; then risk of decline would return to center-stage. Of course ‘at best’ is hard to define; because we have a string of earnings reports in the week ahead, as well as an FOMC meeting.

For the earnings reports, they are generally soft, which is notable since equity guidance was already constrained and defensive for months. Missing lowered numbers, in other words, shouldn’t be very encouraging. Then there’s the Fed; if they retreat in their ‘Statement’ (no News Conference scheduled) to the usual ‘data-dependent’ remark; that will be taken as ‘dovish’ by traders, who will then rally the market; though it might be sold-into after that. You cannot really return to a ‘bad news is good news’ backdrop; though Wall Street seems eager to do just that. (Anything so long as it lets them pull money in and move stocks up.)

Bottom-line: we expect (barring exogenous events) to see prices move higher for the moment; but not necessarily much higher. It does not matter if the peak of this is 1920 or the 1960’s in the March S&P; either way would eliminate what had become an extreme oversold condition and set-up a turn back down. How deep that goes is technically debatable, while fundamentals argue a lower low.

All of these technical considerations (and more) should be balanced against of course the Oil market; the bellwether behavior of Apple (it’s report coming out too; the push from the Street about a 50% up move is more based on its status of market leader, not really the corporate or sales outlook; although I inherently agree over the very long term, and I’ve discussed that before.. we did mention it was crazy for traders to be selling in the 90’s, as that was and may be again, our target zone for the sale suggestion both at 128-132 and again around 120); and other factors like GDP probable growth rates, aside default risks or China.

In sum: there’s a ton of issues and challenges and potential deviations from an outlined ‘probability’ pattern; including our own. The most dangerous would be a move by the ECB or our Fed to increase stimulus or new Quantitative Easing measures; as these already proved our point about being counterproductive in the raw sense (more so in a somewhat de-industrialized country like the US; as contrasted say to Germany, which did benefit from such programs, but also has retained responsibility in ‘debt management’ unlike the US or some others).

So if you got a rally extension based on admission things are so bad they want to artificially stimulate the illusion of growth; then of course financial assets will become elevated; although that should be politically and logically unpalatable in that many now understand that it’s akin to pouring gasoline on a debt fire. With a presumption they don’t do that; you can envision the market going ultimate to lower lows; but as I’ve said frequently; this is a ‘process’ (marathon not sprint).

The plunge through the ‘vacuum’ was part of the outlined process; as is this lift we’re seeing now. And that’s my point: even when it exhausts (which ideally is at least a couple days more, maybe longer) you won’t know immediately if it’s a test of the past week’s lows for awhile. That is normal and will be very topical in the days and weeks just ahead. Our bias (subject to change) is for odds heavily in favor of an ultimate break to lower lows; but again; we didn’t expect it quickly.

Once we get that, presuming we do, then danger increases rapidly because an inability to sustain the relief rally below the former support (now resistance) will point lower right into the ‘no-man’s land’ snowbank, from which it will be harder for Bulls to plow their way out of. (More below plus via weekend video.)

Leave A Comment