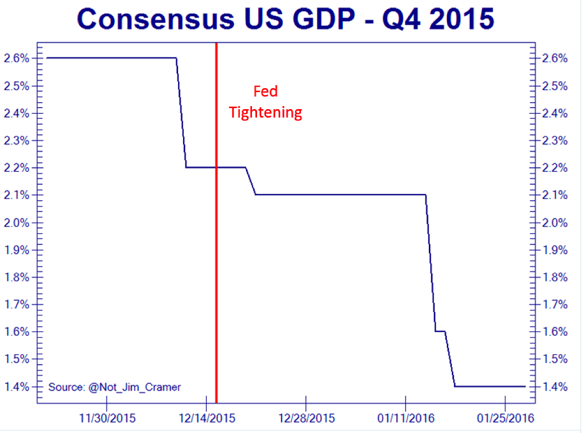

Wall Street’s rationales for investing are eclipsed only by the spin of political correctness that has portrayed everything as being better, if not great. Even the FOMC Statement today gave hints of imbalances that the Fed either doesn’t understand, dares not describe, or would simply negate the public reasons for hiking rates. We felt this is what they would do even though, after the recovery cycle had peaked last summer, it was of course too late and would thus backfire.

So they left it to the uncertain category that leaves lots to the eyes of beholders (read it dovish or hawkish, as one wishes). Candidly the markets were turning back south; so was the economy; well before the Fed’s move on rates. Recall our view of the S&P topping in the spring; dropping back; reviving into summer with an ideal early-mid July top; and then sagging, with a plunge into the abyss sort of delayed until the technical algorithms forced selling later on.

We discuss the FOMC a bit in the 2nd video; but it matters since the perception among most pundits is that all would be good if the Fed had only reversed their policy. No; and that’s the point of the market topping before the July economic peak (roughly); as well as the coincident tracking of a new recessionary phase back to that approximate time as well (something else I’ve contended based on factual charts not interest rate moves taken alone). That means that even if the Fed has cut rates, and you got another rally, it would be unsustainable, as the problems permeating the economic scene now have far greater substance than a mere Fed adjustment can easily address.

We have several new readers I’d refer to the summaries below for a glimpse of the flow of the overall pattern, which was expected to be interrupted by focus on earnings – whether Boeing (BA) or Apple (AAPL), both of which we thought would be soft for reasons mentioned, or spurred by excitement over Facebook (FB) doing well). In the grand scheme of things; none of this is the overarching concern.

Leave A Comment