I want to spend some time here discussing a different way to analyze stock investments and an investment strategy that does not involve trying to find stocks that will go up more in value than the market averages. While I find it very difficult to find stocks that will consistently generate above average capital gains, I find it an easier task to build a portfolio of stocks that will provide me with a cash flow pay raise every quarter.

The strategy I use is to focus my search on finding higher yield stocks with histories and future potential for regular and growing dividend payments. Most stock market analysts, advisors, and investors themselves focus on new products, revenues, earnings per share, and share prices and what effects the latest economic news will have on the individual company metrics. The result is a blizzard of information that is often contradictory and share prices that end up moving up and down together, no matter how good the prospects of an individual company might be. Recently the “experts” were proven right when the market corrections they had been predicting since 2013 finally happened. Yet most investors had been buying shares on the ride up from the last correction in 2011 and many, many sold out when prices of a large number of stocks dropped by more than 20% in the third quarter of this year. These investors let their worries about share prices push them to sell low, after buying high.

A dividend focused approach to stock market investing takes out the part where investors have to try to figure out whether share prices are going to go up or down, and which stocks will do better or be able to buck the trend if the market is falling in general. With a dividend-centric investing strategy, you work to find stocks with attractive yields and growing dividends. These stocks will produce a growing cash flow stream and also, in the longer term, generate high share prices. Let’s look at a couple of examples:

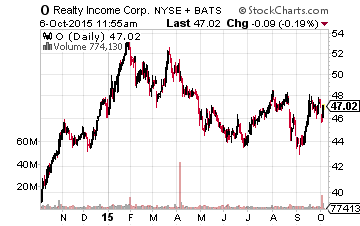

Realty Income Corp (NYSE:O) is the poster stock for this cash flow focused investing strategy. This conservatively managed REIT has increased its dividend rate 81 times in the last 20 years, with zero dividend reductions. There have been 72 consecutive quarterly increases, or six straight years of quarter over quarter dividend growth. During the last decade, the yield on O has ranged from about 4.5% to around 7.5%. The dividend growth rate has averaged 5% per year. The regular dividend payments with steady growth in those dividends has produced an average total return of over 15% per year from Realty Income. And as a bonus, the company pays monthly dividends.

Realty Income Corp (NYSE:O) is the poster stock for this cash flow focused investing strategy. This conservatively managed REIT has increased its dividend rate 81 times in the last 20 years, with zero dividend reductions. There have been 72 consecutive quarterly increases, or six straight years of quarter over quarter dividend growth. During the last decade, the yield on O has ranged from about 4.5% to around 7.5%. The dividend growth rate has averaged 5% per year. The regular dividend payments with steady growth in those dividends has produced an average total return of over 15% per year from Realty Income. And as a bonus, the company pays monthly dividends.

Leave A Comment