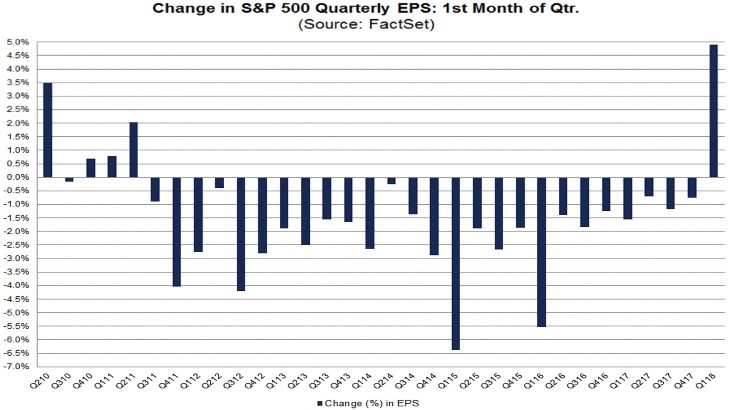

With all the crazy action in the markets, I’m recapping the latest earnings results a bit later in the week than usual. The big change this week was the acceleration in analysts’ estimates for Q1 earnings, full year 2018 earnings, and 2019 earnings. This was expected because many analysts waited until after firms reported Q4 results to update their models to include the effects of the tax cuts. The savings are dropping straight to the bottom line. As you can see from the chart below, estimates for Q1 earnings in the first month of the quarter are up 4.9%. That’s a big deal because usually the earnings expectations fall in this period. This is the biggest improvement in estimates since FactSet started calculating these estimates in April 2002. That’s means this is the best month in two business cycles. The 10 year average decline in the first month’s earnings estimates is 2.5%. There probably would have been a less than normal decline without the tax cut because recent quarters have been solid. Q1 earnings growth is now expected to be 16.9% and revenue growth is expected to be 7.1%. This shows the strength of the tax cut effect because it improves margins more than revenues.

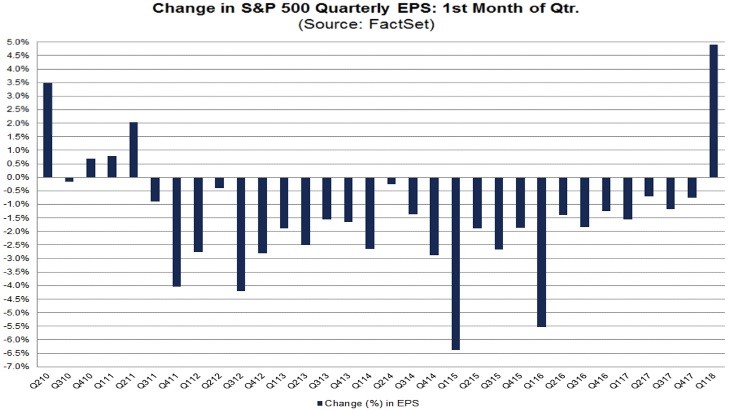

The improved estimates for the full year are even more impressive than the Q1 estimate improvements. As you can see from the chart below, the aggregate 2018 earnings estimates increased 5.3% in January, going from $147.23 to $155.09. This is the largest increase since at least 1996 which is when FactSet started calculating these estimate changes. The 2019 earnings estimates increased from $169.09 to $171.89. Now the S&P 500 has a 2019 PE multiple of 15.7. A declining stock market and increasing earnings estimates gets the multiple to shrink quickly. The main question investors need to consider is when the earnings estimates fully reflect the impact of the tax cuts. Once they do, I expect a moderate decrease in estimates like usually happens. However, because I think there’s still more upside in estimates because the tax cuts aren’t fully in the numbers, that final decline might be to a higher result than the current estimate. The Shiller PE will be perennially high if the corporate tax rate stays this low.

Leave A Comment