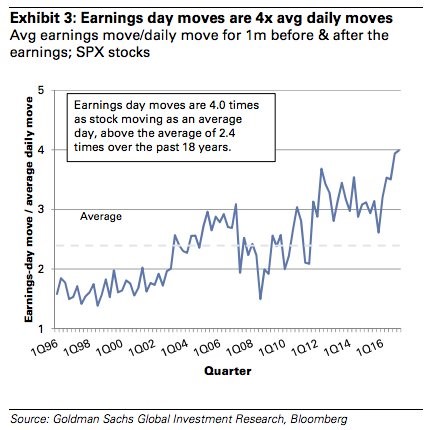

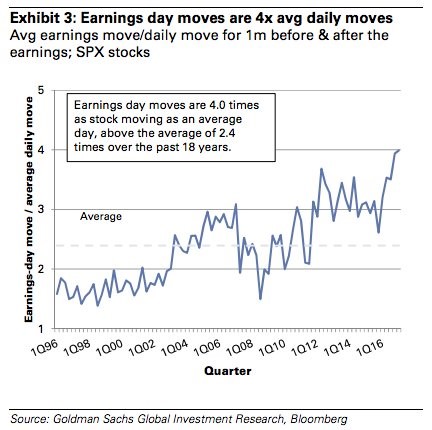

One of the most important new trends is that stocks are becoming more volatile during earnings season. As you can see from the chart below, earnings moves are 4 times the size as the average daily move. The most obvious explanation that many give for this is the prevalence of ETF investing. ETF investors don’t care about valuations and fundamentals. They aren’t studying how big a firm’s moat is. That’s a big advantage for stock pickers as you get these great firms at a discount assuming you can spot them. ETF investors dominate trading when earnings aren’t being reported. Then when earnings are reported, the traders who focus on the short term move the stocks. This can be problematic for ETF investors. It shows that fundamental investing isn’t dead.

This is great news because Japan is having problems with moral hazards. The central bank is buying stock ETFs. It is a passive investor which doesn’t reward great reports which means incentives for good execution are eliminated. This hurts innovation and productivity. While the Federal Reserve isn’t buying stocks and the Swiss Central bank doesn’t own enough stock to manipulate the whole market, ETF investors are still passive investors which could have a similar effect to central banks. The JCB buys ETFs just like investors in America. The difference seems to be that the JCB is shrinking the float of stock which can be traded as investors don’t think the JCB will ever sell. If you only think the JCB will buy stocks, you would simply ride the wave. There’s no point in trading it.

In America, ETF investing is a new phenomenon. Many investors, like myself, don’t think the trend will last forever. I think ETF investing will reverse in the next correction when it is exposed to the full brunt of the crash. If you think the market isn’t rigged to go higher, then trading individual names makes sense. It’s a self-fulfilling prophecy at this point because the market’s action is proving that fundamental investing still works since stocks are volatile around earnings season. This encourages traders to participate, making for more volatility.

Leave A Comment