AT40 = 41.1% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 51.7% of stocks are trading above their respective 200DMAs

VIX = 13.1 (as high as 14.5)

Short-term Trading Call: cautiously bullish

Commentary

The narrowing rally in the stock market has officially resolved into a sell-off. The downward slide is a very slow burn, but the market looks like it wants to drop as key levels get broken.

AT40, the percentage of stocks trading above their respective 40-day moving averages (DMAs), has declined in a near straight line since it last peaked in overbought territory on October 5, 2017. My favorite technical indicator closed at 41.1% and approaches “close enough” oversold territory (the 30s%). Both AT40 and AT200, the percentage of stocks trading above their respective 200DMAs, closed at 3-week lows.

AT40 (T2108) closed at a near 3-month low as part of a convincing 6-week decline.

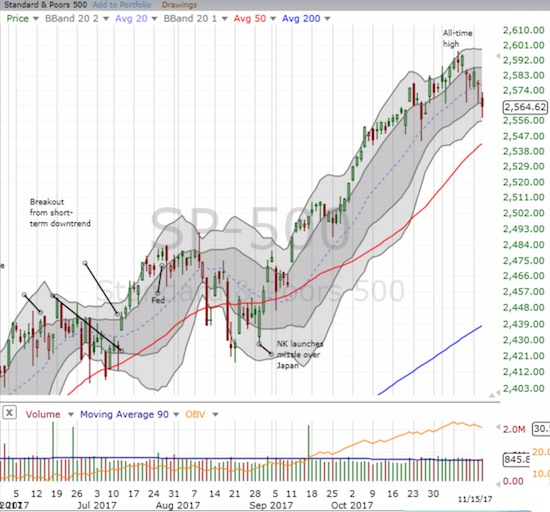

The orderliness of the decline surprised me, especially during October, given it never resolved into a (traditional) October sell-off for the broader market. For example, the S&P 500 (SPY) continued rising throughout October and did not peak until a month after AT40 peaked. The long overdue resolution of the bearish divergence has now taken the S&P 500 to a new three week low.

The S&P 500 broke through the intraday lows of the last week – levels that buyers staunchly defended. No longer.

The S&P 500 closed below its rapidly uptrending 20-day moving average (DMA) for the FIRST time since August 29th. This change in the nature of trading increased the likelihood that the S&P 500 will retest support at its 50DMA within the next two weeks at the current pace. I am guessing the (successful) test will happen just ahead of Black Friday (November 24th) which tends to be a bullish turning point in the market.

The volatility index, the VIX, is actually confirming the downward bias. Despite the consistent efforts of volatility faders, the VIX is up 44% in two weeks with gains 7 of the last 8 trading days. The rally is almost a stealth rally because each day the VIX fades significantly off its intraday high. This is a pattern I finally traded on today.

Leave A Comment