Search “options and volatility” in Google and you’ll get a dozen websites that say the same thing: option buyers want high volatility and option sellers want low volatility. Oddly enough, this old and relied upon rule of thumb isn’t completely correct.

In reality, as an option trade plays out, trend has a far more powerful effect than volatility on final P&L.

There are four scenarios that can occur before an option expires:

The charts below illustrate the P&L of a long put in each scenario.

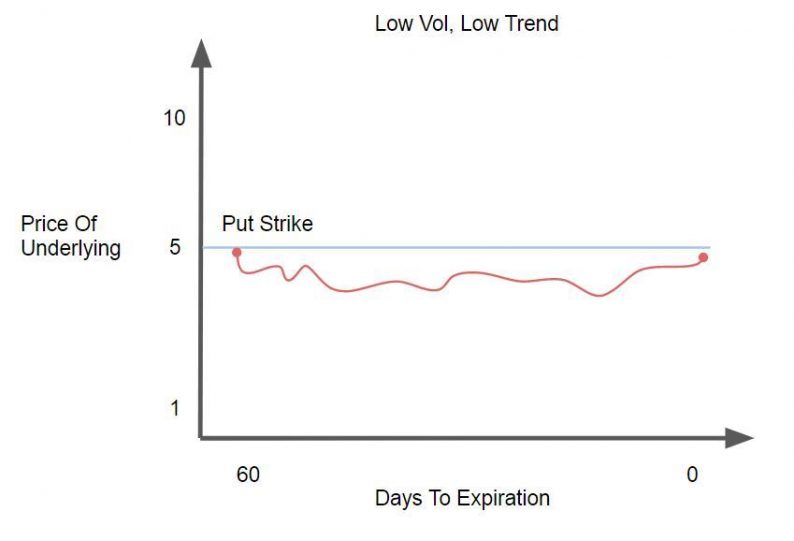

Example 1 — Low Vol, Low Trend

The red path is the price action of the underlying stock over the course of the trade. Notice how it moves along smoothly with little volatility.

In this example, the long put would expire at a low price. The underlying (red line) isn’t far enough away from the strike price at expiration. A trader who bought this put would’ve lost money.

Example 2 — Low Vol, High Trend

In this situation the put holder would be sitting on a huge gain! The underlying trended far away from the put strike and the option expired well into the money. Just like the last example, the red line moved smoothly. But in this case it happened to trend down instead of sideways. Despite low volatility, the put holder made some serious money. The “rule of thumb” requiring high vol broke down.

Example 3 — High Vol, Low Trend

The put buyer lost money here. The underlying didn’t trend far enough away from the strike to overcome the option premium. There was high volatility throughout the life of the trade, but the put buyer still got taken to the woodshed. The price of the underlying at expiration was all that mattered here. The volatility “rule of thumb” broke down again.

Example 4 — High Vol, High Trend

In this final example, the put buyer received a nice profit. The underlying trended downward with steep pullbacks, but price was far enough away from the put strike to deliver gains. In this situation many traders would think the high vol over the course of the trade contributed to profits. But in reality it didn’t. The trend created the profits.

Leave A Comment