The other day I stumbled upon this great tweet from Holger Zschaepitz, the senior editor of the financial desk of the German newspaper, Die Welt.

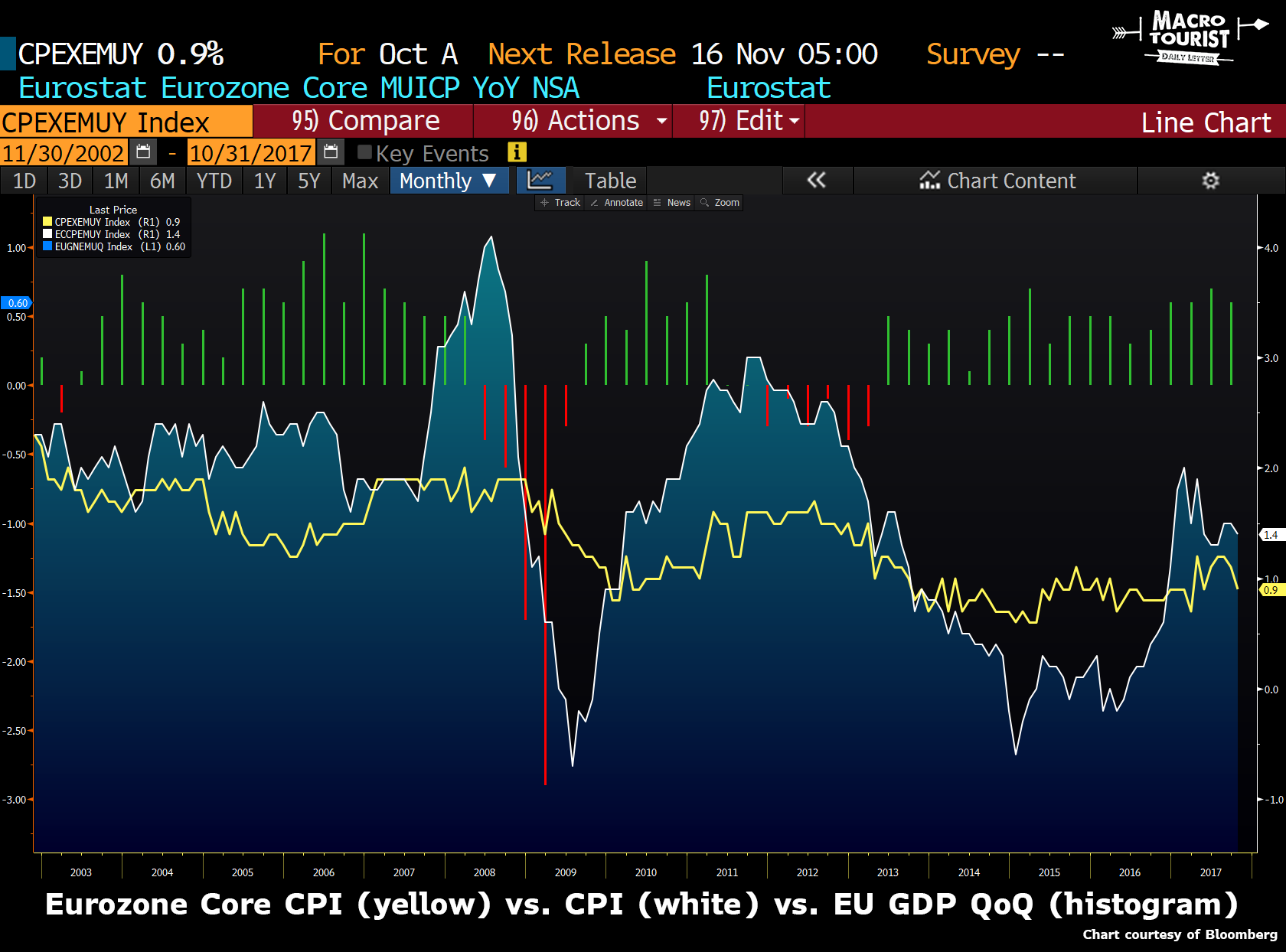

I have often said the last thing any equity bull should hope for is a strong economy, especially one accompanied with an uptick in inflation. A near perfect nirvana environment would be one with low inflation and, decent, but not exploding growth. And low and behold, this is exactly what Europe is experiencing.

Inflation is stumbling just enough for the ECB to err on slowing the pace of their tapering, but meanwhile, the economy is ticking slightly above expectations. What’s the result of this combination? Quantitative easing for slightly longer. Nothing like the Central Bank goosing financial markets higher with more blue tickets.

If the economy and inflation were both running a percentage point higher, what do you think would be the ECB’s response? They would be tapering (and maybe even tightening) at a much quicker pace. So ironically, a slightly below target economy could well be the absolute best environment for stocks. When Holger describes the current EU economic numbers as Goldilocks, I must admit, I concur completely.

Shadow rates

Over the past decade, as more and more countries have adopted ZIRP (zero interest rate policy), with some even pushing down to NIRP (negative interest rate policy), economists have struggled with a way to measure the degree of accommodation that their unconventional policies were exerting on the economy. First introduced by Fisher Black in 1995, the concept of a shadow rate gained widespread adoption in days following the 2008 Great Financial Crisis. There are various models, with the Wu-Xia model gaining prominence in the United States. However, the Reserve Bank of New Zealand has created models for a wider swath of countries, and these series are rising in popularity.

Although the math for these shadow rates is complicated, the important thing to realize is that if rates are positive, shadow rates are essentially the same as the actual rate. But when rates hit zero (or below), the shadow rate measures the theoretical negative rate. Even though US rates never went below zero in the last cycle, the shadow rate was deep into negative territory at the height of Bernanke’s quantitative easing madness.

Leave A Comment