There is an eight foot broadleaf evergreen directly outside my office door. Normally, I would not give it a second’s glance. Recently, however, a hummingbird has been buzzing about the greenery. And with good reason. Two hatchlings have arrived, requiring food as well as warmth.

In spite of my presence, the mother has been expressing an unusual amount of audacity. She does not flinch when I walk near the nest. And when she’s out gathering insects to feed her young, she returns to the shrub as if she owns it. My colleague Rob jokingly suggested that we name the siblings “Irrational” and “Exuberance.”

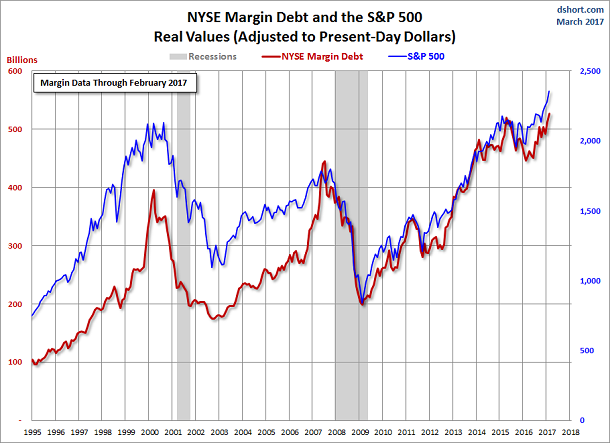

The investing public is confident alright. There’s no doubt about that. There has never been as much leverage in the market-based financial system as there is right now.

Consider margin debt. It is hitting all-time records alongside the major stock market averages. And while there’s no sure-fire way to determine when stock market ascension or brokerage account borrowing will subside, skyrocketing leverage tends to peak at exceptionally inconvenient moments; that is, when the act of borrowing to buy stocks swan dives, bubbly stock prices typically head south for the winter, spring, summer and/or fall.

Take a look at the chart above. Leverage as seen in the red line surged in 1999, only to abruptly reverse course by March of 2000. The tech bubble popped in March of 2000. (Note: The S&P 500 hung in there until August of 2000 before giving way to a two-year, six month price evisceration.) Similarly, as measured by margin debt increases, investor enthusiasm catapulted higher in 2006. By mid-2007, though, leverage made a hasty retreat. And by October of 2007, stocks cratered. They reached unimaginable lows nineteen harrowing months later.

Some strategists argue that there is nothing irrational or overly exuberant about borrowing the most that one can from his/her brokerage account. He/she can buy stocks, finance a trip around the globe or even come up with more money for a real estate acquisition. And at these ultra-low interest rates, why not?

Leave A Comment