It’s coming.

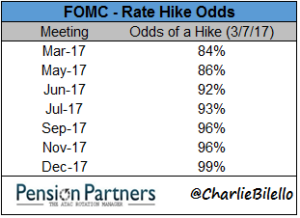

Market participants are expecting the third Fed rate hike since December 2015 at next week’s FOMC meeting. This is a move up in expectations from the start the year when market participants were saying no hike would occur until June.

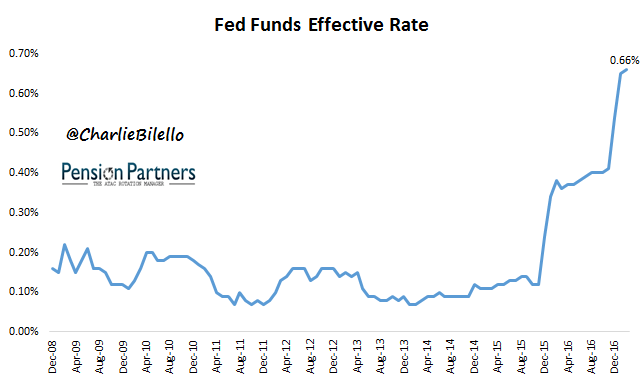

The Fed Funds Effective Rate is now at its highest level since 2008, and will push higher again if the Fed meets market expectations.

3-Month Treasury yields are at 8-year highs ahead of the meeting, already discounting another hike.

With rates on the short end rising at long last, there is much speculation from pundits on the supposed impact on markets. If you listen to the pundits, they will tell you that the impact will be negative. They have been saying so since the first rate hike in December 2015.

And since that first hike, the S&P 500 (total return) is up over 19%, hitting 46 new all-time closing highs. If you thought that fact would silence the pundits, you would be wrong. They are out again saying the March hike will lead to a collapse.

Which begs the question: is a sharp move higher in the Fed Funds rate a reliable warning sign of an imminent collapse?

Not exactly.

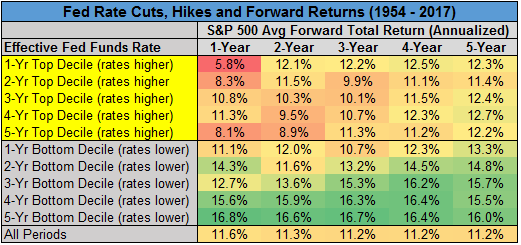

Going back to 1954, the largest (top decile) moves higher in the Fed Funds rate over a 1 to 5 year period were all followed by positive returns on average over the subsequent 1 to 5 years.

It is true that these returns were typically below average in the 1-3 year forward time frame, and certainly below the periods following times when rates were moving lower, but they were still positive.

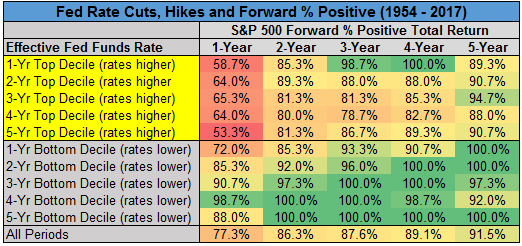

In terms of the percentage of positive returns, we find a similar result. Large moves higher in the Effective Fed Funds rate tends to be followed by lower odds of a positive return, but the odds are still above 50% in all periods.

Now, it is important to keep in mind that the move higher in the Effective Funds Rate today is nowhere near the top decile. To qualify for the top decile over a one year period, the effective Fed Funds Rate would have to rise by at least 2.2%. Even if the Fed hiked 3 times this year it would only be a 1% year-over-year move.

Leave A Comment