The Current Situation

We have last discussed the gold sector in a series of posts between August 11 and September 1, arguing that an interesting risk-reward proposition could be discerned, both from a longer term investment perspective and a shorter term trading perspective. In particular, with a major support level nearby, and a great many similarities in the technical set-up to previous significant lows (plus a fundamental backdrop with growing potential to shift to a more bullish configuration), an opportunity combining potentially high return with minimal risk had emerged again (meaning that risk could be minimized by using the nearby support level as a stop).

Photo via stockmarketgps.com

These posts can be reviewed here in chronological order: “Gold Stocks at an Interesting Juncture”, “A Playable Rally May be Beginning” and “Update on a Tricky Situation”. Considering that in the brief rally between late December 2014 to late January 2015, numerous individual gold stocks rose between 100-200%, opportunities of this sort are nothing to be sneezed at, even if the bear market resumes again later. This view was a fairly lonely one at the time, which is no surprise given the awful performance prior to the low being put in. In the meantime a worthwhile advance has indeed gotten underway, even if it has taken a few more retests of the low before things really got going:

Click on image to enlarge

The action in the HUI index over the past year. During the recent period within the blue rectangle on the right hand side we discussed the emerging new opportunity (we incidentally did the same after the capitulation in late October 2014)

One thing that should be immediately clear is that there is nothing yet that can either confirm or disprove that anything more significant than another short term advance is underway. However, there are a few differences to the last rally, which we will discuss further below. However, the main point is this: it is entirely possible that the current rally will once again fail in the vicinity of the 200-day ma – but even if it does that, it will have been well worth playing it, as even now, with the index up a little less than 30% from its low, numerous individual issues have already posted quite impressive gains and even bigger gains seem likely over coming weeks.

There still remains some distance to be covered before serious chart resistance is encountered, resp. the 200 dma is reached. Naturally, this is not going to happen all at once – in fact, it appears as though a short term pullback may have begun, resp. is fairly imminent. Such a pullback would likely represent a buying opportunity. It should ideally last a few days at most and be characterized by positive internal divergences (with some individual stocks performing noticeably better than the index).

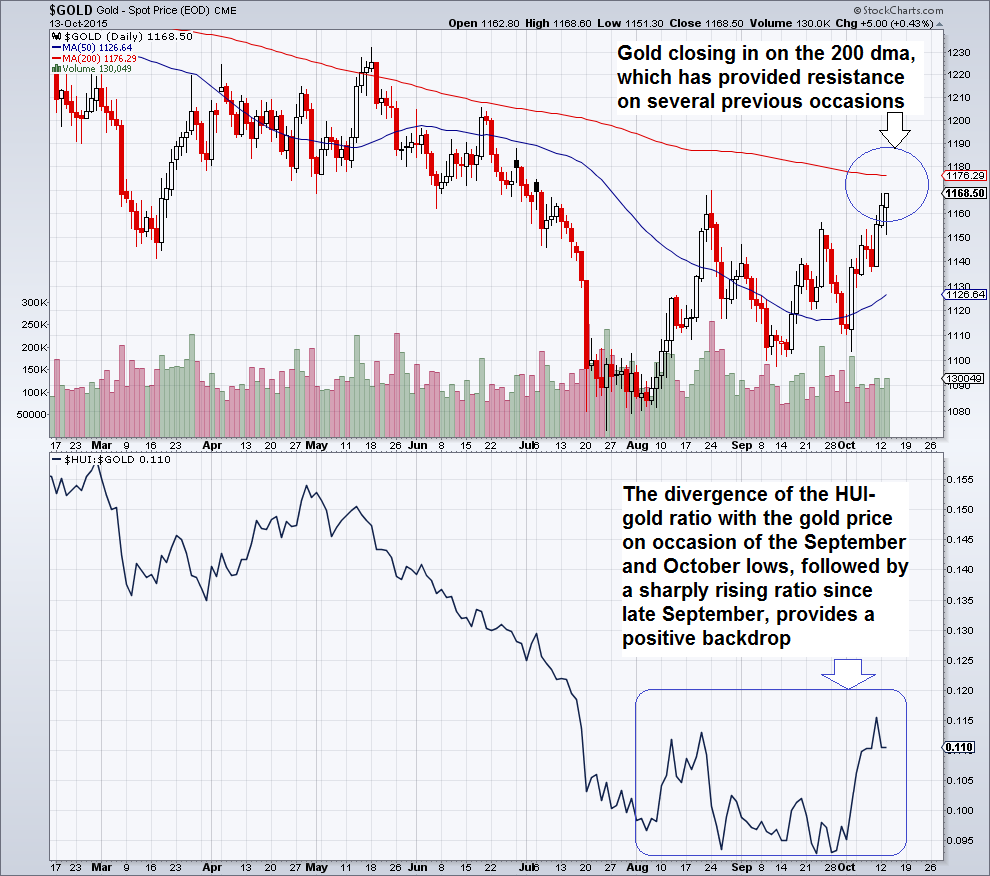

There are two reasons why the advance may encounter resistance in the short term: Gold is close to its own 200 dma, and in silver, the previous positive divergence between its market price and its fundamental price suggested by the cobasis is no longer in evidence as Keith Weiner reported on Monday (incidentally this happened just as silver reached its 200 dma).

Click on image to enlarge

Gold and the HUI-gold ratio. Although resistance is close, the general backdrop remains positive for now

In summary, we can state that it is highly likely that there is more room to the upside following a short term pullback; and secondly, we cannot be certain yet if the bear market will resume thereafter, or if a more significant rally is in store. Initially, a major trend change is in almost all respects indistinguishable from a bear market bounce.

Leave A Comment