Introduction

I recently wrote a piece on what can be expected from blockchains and crypto-currencies. But there are other important changes taking place in the global investment industry. And some of these are just summarized in a series of articles from McKinsey & Company. In what follows, I comment on a number of the changes discussed in the McKinsey pieces.

McKinsey: North America remains the world’s largest asset management market by far, accounting for about half of total assets under management (AUM) but from 2012 to 2016 the region accounted for only about 20 percent of flows. And in 2016, North America was the only major global region where flows turned negative, with outflows of $161 billion despite rising markets. Low returns, lower flows, pricing pressure, performance challenges, a massive shift to passive, stubbornly increasing costs, and margin compression are all leading to a distinctly gloomy mood among the industry’s ranks.

It is very hard to feel sorry for the global asset managers. According to Pensions & Investments, the 500 largest managers are earning fees to manage $40 trillion in assets.

The Swing to Passive

Buffett said to invest in low-cost index funds and apparently a lot of people listened.

McKinsey: Much attention has been focused on the massive flows into passive investments [mostly ETFs] in North American asset management. Market share of passive has indeed grown materially, from 12 percent in 2010 to 18 percent in 2016. Yet, interestingly, passive’s share of the industry revenues has remained a constant 3 percent, as its growth has been accompanied by (and arguably driven by) aggressive price competition.

US Data

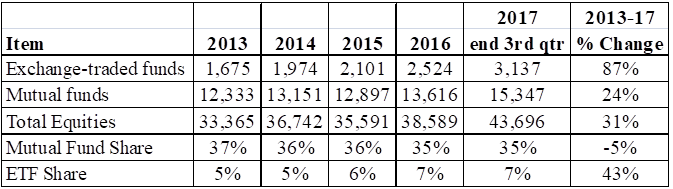

The Federal Reserve’s flow of funds data are presented in Table 1. The growth of ETFs is apparent. However, even with their rapid growth, they constitute a small share of total equity holdings. It is worth noting that “pension entitlements” were almost $23 trillion at the end of September and a significant portion of ETFs and mutual funds were purchased for investors via pensions.

Table 1. – Equity Holdings by Type (bil. US$)

Source: Federal Reserve

Passive versus Active Management in Emerging Markets

In an earlier piece, I argued that you should have Chinese equities in your portfolio. I went further: I am not alone in believing that picking stocks in the US is close to being a random bet because new information is almost instantly reflected in stock prices. And studies have shown that the majority of mutual fund managers underperform their market indices. However, Chinese equity markets are not perfect. And as Chinese policies change, a plausible argument can be made that you should invest in a fund with a “seasoned” Chinese investor in control.

Leave A Comment