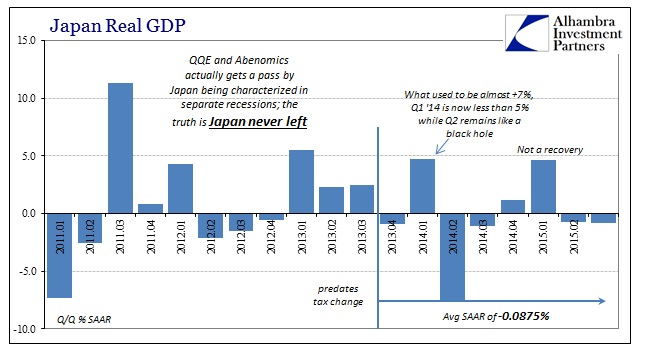

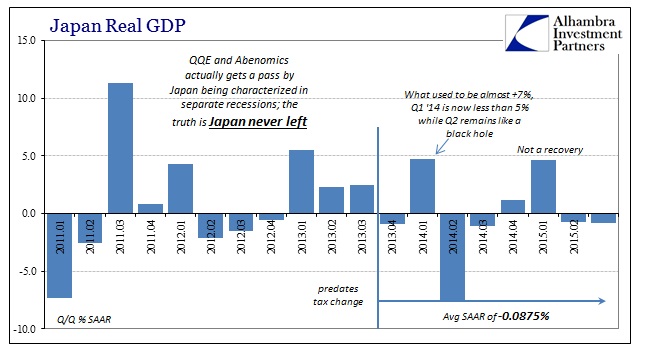

Japan fell back into recession again in Q3, expected this time, which is actually being charitable to Abenomics and especially QQE. To even believe that this monetary insanity has produced even marginal benefits, it has to be given “credit” of at least mini-recoveries in between these “technical recessions.” It is a problem far worse than that, as even a technical recession exists only in the media. By all that truly counts, Japan has never left its QQE-induced hysteria, and thus the Japanese economy has remained distinctly subdued throughout.

Japan’s economy contracted in the third quarter as business investment fell, confirming what many economists had predicted: The nation fell into its second recession since Prime Minister Shinzo Abe took office in December 2012.

Gross domestic product declined an annualized 0.8 percent in the three months ended Sept. 30, following a revised 0.7 percent drop in the second quarter, meeting the common definition of a recession. Economists had estimated a 0.2 percent decline for the third quarter.

Going back all the way to the fourth quarter of 2013, not long after QQE began, Japan’s GDP has averaged a very slightly negative rate. Owing to compounding effects and time, Japan’s real GDP level in Q3 2015 is actually slightly above what it was when QQE began. In other words, where even GDP has not grown for more than two years you can count that as a single and ongoing recession with variation in between that does not change the overall trajectory. The fact that the quarterly levels appear highly unstable only produces the common QE element, one which, as everyone should appreciate, is being reproduced by the US and Europe.

What is obvious about GDP in Japan is also what is obvious about GDP in the US – the upside variations are far more infrequent than the “unexpected” setbacks. That unstable nature, given this inter-geographical reproduction says a lot about monetary policy and its intrusive nature. If there is a difference between them, the regular downside in Japan’s GDP versus the US’, it is perhaps only subjectivity with which each is applied (trend-cycle especially in the US version) that skews the appearance of those downsides more favorably here (“residual seasonality” being just the latest to produce a positive number instead of where in Japan it would be another negative). In the end, however, such degrees are nothing more than splitting hairs about just how much of an economic “hole” has been produced by what is still, somehow, counted among “stimulus.”

Leave A Comment