If China and US manufacturing are suffering from what looks like the contours of a slowly progressing recession, we don’t have to go very far to find the genesis. The common denominator is and has been US consumers. That much is evident in very clear fashion through retail sales during the Christmas season that were abysmal. The BEA’s update for full PCE figures shows mostly the same, even though overall PCE is highly influenced by “services” spending in the form of imputations and, where evident, services in the form of a tax (health care).

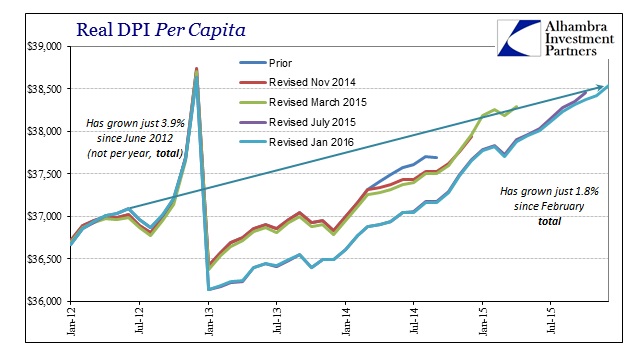

Real PCE spending was slightly negative in December month-over-month, which suggests another reason why GDP disappointed without too much snow or “residual seasonality.” That makes two of the last three months with essentially zero spending growth despite both what the BEA suggests as somewhat rising income and no “inflation.” This has been an issue with these data points for some time, as the BEA continually suggests that income is rising faster than spending only to revise income lower in persistent fashion. This dichotomy is highlighted by the personal savings rate, which in count of repeated revisions appears as just noise almost without discernible pattern.

Each time the savings rate moved up erratically (before the current spike) the BEA would eventually counter with a downward revision to income.

Even still, the current trend in income growth remains lackluster by any reasonable standard, which is worse than even that appears in “real” terms since there is little to no calculated “inflation” subtracted in the past year or so. As a result, the savings rate has risen to the highest since 2012 as consumers aren’t following these numbers.

In nominal terms, personal spending growth is as low as it was into the middle of the Great Recession and equivalent to the lowest point in the dot-com recession (just like 2012). The real PCE estimates would suggest that near-zero inflation is a significant difference in favor of the overall economic growth trend but the savings rate and other economic accounts show strongly otherwise.

Leave A Comment