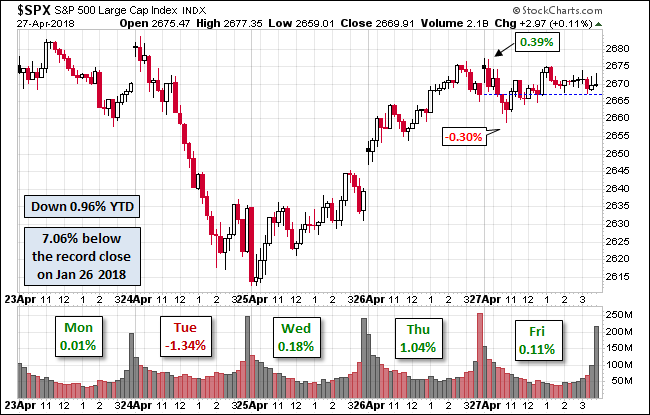

The S&P 500 again plunged at the open, selling off to its -1.62% intraday low at the end of the first hour of trading. The index then bounced and vacillated until a 2 PM rally lifted it to its 0.79% intraday high at the start of the final hour, which had its own trading mini-drama, which ended in a modest gain of 0.50% for the day. The index remains in correction territory, down 10.24% off its record close in May of last year.

The yield on the 10-year note closed at 1.88%, up 1 basis point from the previous close.

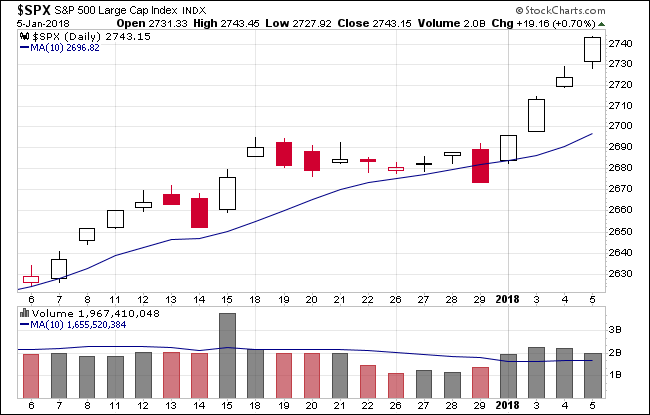

Here is a snapshot of past five sessions.

Here is a daily chart of the index. Volume increased on today’s volatility.

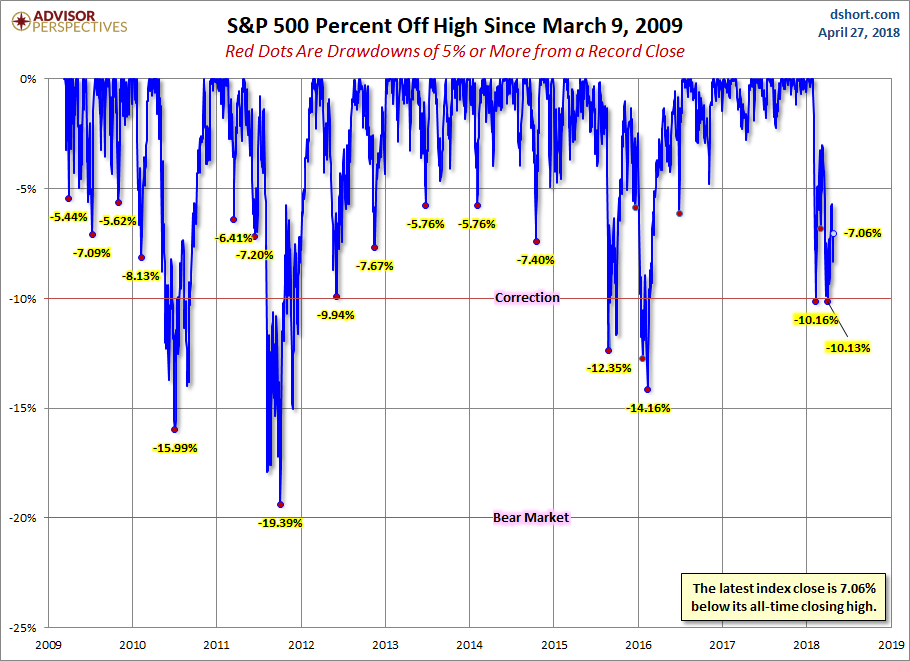

A Perspective on Drawdowns

Here’s a snapshot of selloffs since the 2009 trough.

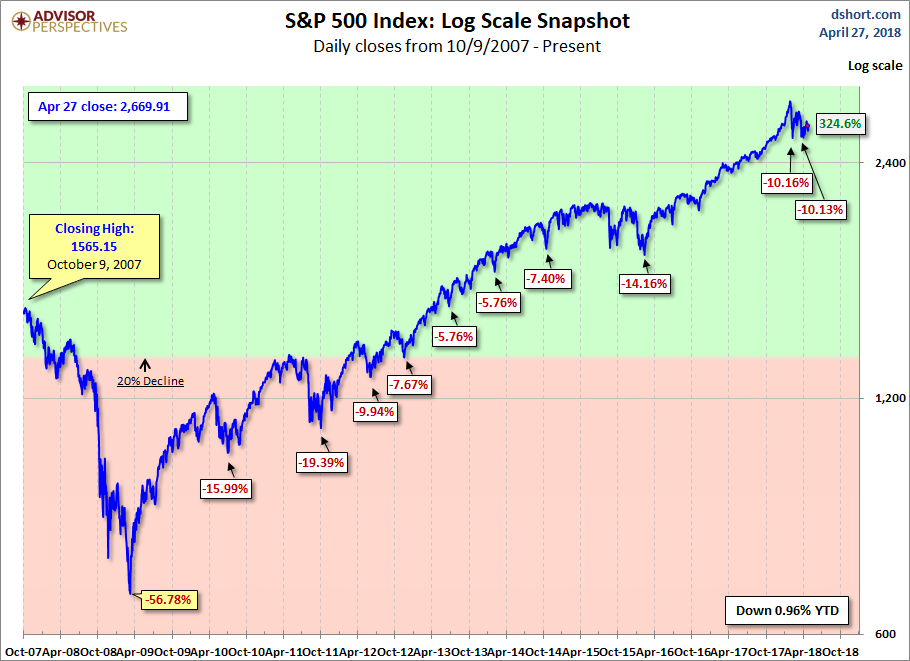

For a longer-term perspective, here is a log-scale chart base on daily closes since the all-time high prior to the Great Recession.

Here is the same chart with the 50- and 200-day moving averages.

Leave A Comment