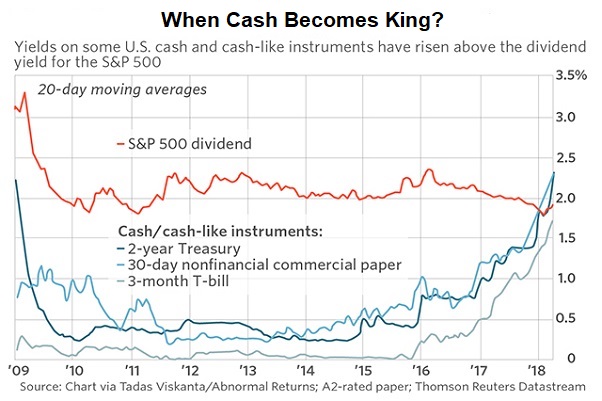

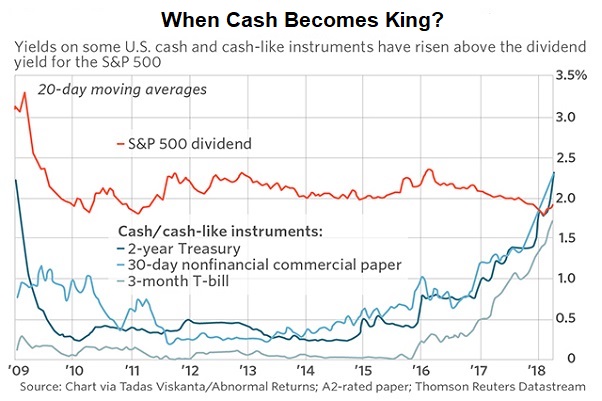

As recently as the November 2016 election, the S&P 500’s dividend yield (2.0%+) was higher than the 10-year Treasury bond’s yield (1.75%). Many exclaimed that ultra-low interest rates alone justified extremely high stock valuations, including a GAAP-based price-to-earnings ratio (P/E) of 25.

A year and a half later, the S&P 500’s dividend yield (1.8%) offers much less than the 10-year’s yield (3.0%) and struggles to compete with cash equivalents. Meanwhile, the benchmark’s GAAP-based P/E is still in the stratosphere at 24.3.

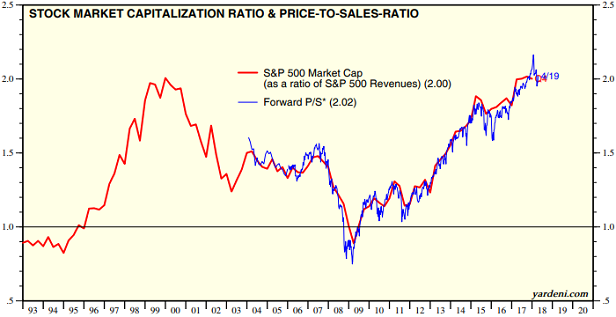

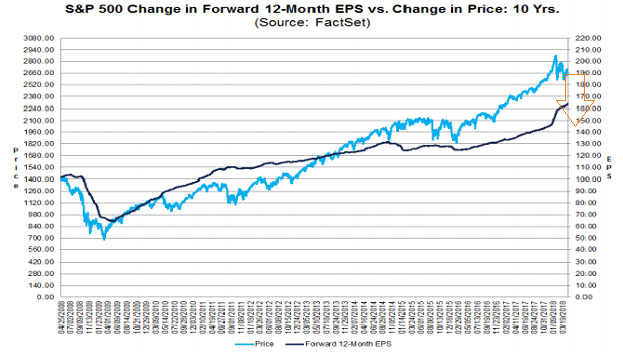

To be clear, stocks are still trading at valuation levels rarely before seen in history. On a wide variety of measures — market-cap-to-GDP, PE 10, Crestmont PE, Tobin’s Q, price-to-sales (P/S), price-to-book (P/B), 12-month price-to-earnings (trailing and forward) — 2018 valuations share a lot in common with 1929 and 2000.

Even the most favorable measure, forward non-GAAP price-to-earnings, would not intrigue a value-oriented investor. The S&P 500 would need to fall to the 2250 level to revert to its mean. That would represent a top-to-bottom bearish descent of 21.7%.

Keep in mind, however, stocks rarely fall from severely overvalued to fairly valued. They frequently overshoot; they typically wind up in undervalued territory. A 30%-plus decline to the 1950-2000 level for the S&P 500 would be far more consistent with bear market behavior.

Some folks believe that ultra-low interest rates may not be as important today because the corporate tax cuts picked up the stimulus baton. Not exactly. Tax cut euphoria for 2018 was accounted for in 2017. In contrast, Federal Reserve policy tightening is still a work in progress, and it will likely continue until a recession or crisis dramatically alters the central bank’s course.

Perhaps ironically, very few people believe that a recession or crisis is around the bend. Even more people seem to feel a recession will announce itself like Steph Curry returning to the Golden State Warriors basketball court.

Leave A Comment