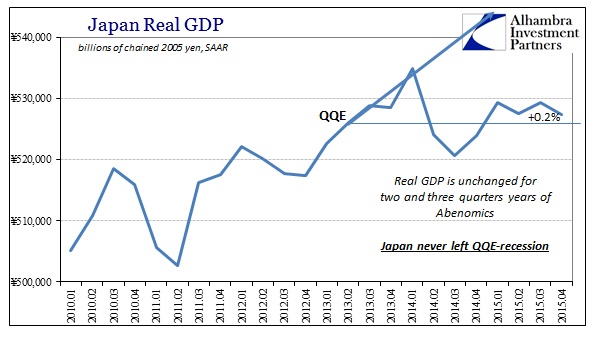

As China, Japan is the definition of insanity. GDP fell 1.4% in Q4 2015, marking the fifth contraction out of the past nine quarters and yet the word “stimulus” remains attached to QQE, the Bank of Japan and Abenomics in general. At this point, how much more time and sample size is necessary before calling it a failure? In about six weeks, Kuroda’s massive “stimulus” will mark its third anniversary and the best that can be said of it is that GDP has gone nowhere. Two and three quarters years later, real GDP (SAAR) in the last three months of 2015 was the slightest bit higher than Q2 2013 when everyone was so sure “stimulus” was all so sure.

The media provides all the evidence necessary as to why everything is so “unexpected.”

The data suggest Japan’s economy is still plagued by the weakness of domestic demand as it enters a fourth year of record monetary stimulus, with wages not rising fast enough to persuade consumers to spend.

There is no sign of a downward spiral in the economy but with the yen rising to trade at Y113.8 to the dollar in recent weeks, the figures put pressure on the Bank of Japan for even more monetary stimulus to encourage a strong round of wage rises this spring.

Wages, first of all, aren’t rising at all let alone “fast enough.” That occurred while QQE was in full force and the yen in full devaluation – in other words “stimulus.” If wages didn’t act as expected over the first nearly three years of “stimulus”, why would they suddenly going forward? The FT’s second paragraph quoted above ignores everything about the first. The mantra for all commentary now into 2016 is that “monetary policy works even though it never has.”

The overall GDP figures are actually quite charitable to QQE, however, as the effects on the actual Japanese people have been devastating. This is not hyperbole. As noted last week under separate but confirming data, the Bank of Japan expanded total bank “reserves” by an overwhelming 339%, unprecedented in every modern fashion; yet Household Income fell by 7.1% in real terms. The GDP estimates for household spending show that, unsurprisingly, households have only cut back and quite seriously.

Leave A Comment