A person often reads that low oil prices–for example, $30 per barrel oil prices–will stimulate the economy, and the economy will soon bounce back. What is wrong with this story? A lot of things, as I see it:

1. Oil producers can’t really produce oil for $30 per barrel

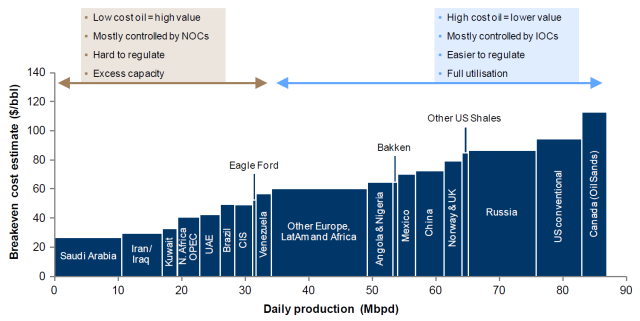

A few countries can get oil out of the ground for $30 per barrel. Figure 1 gives an approximation to technical extraction costs for various countries. Even on this basis, there aren’t many countries extracting oil for under $30 per barrel–only Saudi Arabia, Iran, and Iraq. We wouldn’t have much crude oil if only these countries produced oil.

2. Oil producers really need prices that are higher than the technical extraction costs shown in Figure 1, making the situation even worse.

Oil can only be extracted within a broader system. Companies need to pay taxes. These can be very high. Including these costs has historically brought total costs for many OPEC countries to over $100 per barrel.

Independent oil companies in non-OPEC countries also have costs other than technical extraction costs, including taxes and dividends to stockholders. Also, if companies are to avoid borrowing a huge amount of money, they need to have higher prices than simply the technical extraction costs. If they need to borrow, interest costs need to be considered as well.

3. When oil prices drop very low, producers generally don’t stop producing.

There are built-in delays in the oil production system. It takes several years to put a new oil extraction project in place. If companies have been working on a project, they generally won’t stop just because prices happen to be low. One reason for continuing on a project is the existence of debt that must be repaid with interest, whether or not the project continues.

Also, once an oil well is drilled, it can continue to produce for several years. Ongoing costs after the initial drilling are generally very low. These previously drilled wells will generally be kept operating, regardless of the current selling price for oil. In theory, these wells can be stopped and restarted, but the costs involved tend to deter this action.

Oil exporters will continue to drill new wells because their governments badly need tax revenue from oil sales to fund government programs. These countries tend to have low extraction costs; nearly the entire difference between the market price of oil and the price required to operate the oil company ends up being paid in taxes. Thus, there is an incentive to raise production to help generate additional tax revenue, if prices drop. This is the issue for Saudi Arabia and many other OPEC nations.

Very often, oil companies will purchase derivative contracts that protect themselves from the impact of a drop in market prices for a specified time period (typically a year or two). These companies will tend to ignore price drops for as long as these contracts are in place.

There is also the issue of employee retention. In a sense, a company’s greatest assets are its employees. Once these employees are lost, it will be hard to hire and retrain new employees. So employees are kept on as long as possible.

The US keeps raising its biofuel mandate, regardless of the price of oil. No one stops to realize that in the current over-supplied situation, the mandate adds to low price pressures.

One brake on the system should be the financial pain induced by low oil prices, but this braking effect doesn’t necessarily happen quickly. Oil exporters often have sovereign wealth funds that they can tap to offset low tax revenue. Because of the availability of these funds, some exporters can continue to finance governmental services for two or more years, even with very low oil prices.

Defaults on loans to oil companies should also act as a brake on the system. We know that during the Great Recession, regulators allowed commercial real estate loans to be extended, even when property valuations fell, thus keeping the problem hidden. There is a temptation for regulators to allow similar leniency regarding oil company loans. If this happens, the “braking effect” on the system is reduced, allowing the default problem to grow until it becomes very large and can no longer be hidden.

4. Oil demand doesn’t increase very rapidly after prices drop from a high level.

People often think that going from a low price to a high price is the opposite of going from a high price to a low price, in terms of the effect on the economy. This is not really the case.

4a. When oil prices rise from a low price to a high price, this generally means that production has been inadequate with only the production that could be obtained at the prior lower price. The price must rise to a higher level in order to encourage additional production.

The reason that the cost of oil production tends to rise is because the cheapest-to-extract oil is removed first. Oil producers must thus keep adding production that is ever-more expensive for one reason or another: harder to reach location, more advanced technology, or needing additional steps that require additional human labor and more physical resources. Growing efficiencies can somewhat offset this trend, but the overall trend in the cost of oil production has been sharply upward since about 1999.

Leave A Comment