No Surprises

We were not surprised by the big news last week. We saw it coming. Figures from the Conference Board research group revealed productivity sinking for the first time in three decades. We promised to explain why it was such a big deal.

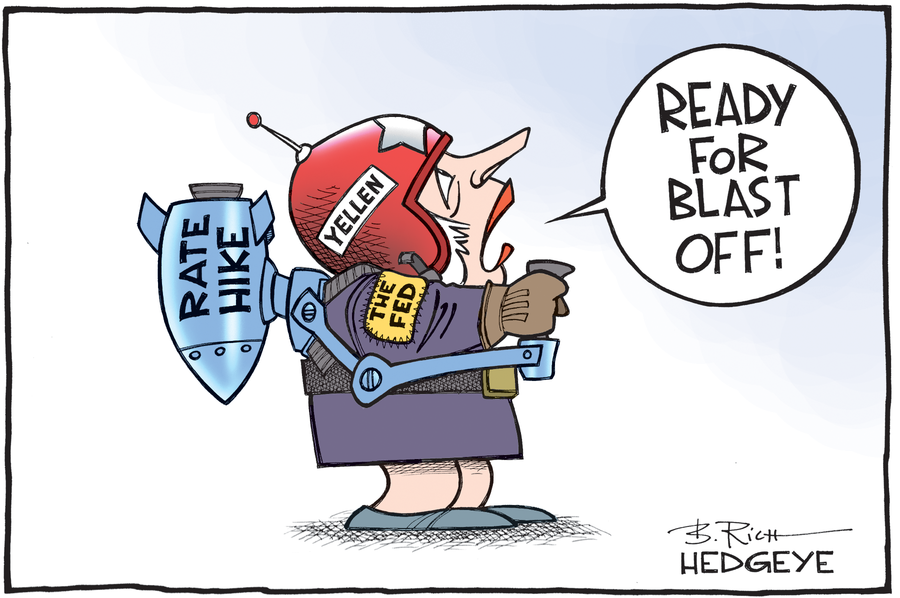

Rate hike fantasies have been a recurring theme since 2009. Given that the market for federal funds is dead as a doornail (banks continue to hold huge excess reserves with the Fed and therefore have no need to borrow any in the interbank market), rate hikes are currently purely for show anyway.

Cartoon by Bob Rich

On Friday, Fed chief Janet Yellen appeared at a function organized by her alma mater, Radcliffe (which later merged with Harvard). Bloomberg was on the scene:

“It is appropriate – and I have said this in the past – for the Fed to gradually and cautiously increase our overnight interest rate over time,” Yellen said Friday during remarks at Harvard University in Cambridge, Massachusetts. “Probably in the coming months such a move would be appropriate.”

Yellen will host her colleagues on the Federal Open Market Committee in Washington June 14-15, when they will contemplate a second interest-rate increase following seven years of near-zero borrowing costs that ended when they hiked in December. A series of speeches by Fed officials and the release of the minutes to their April policy meeting have heightened investor expectations for another tightening move either next month or in July. “The economy is continuing to improve,” she said…”

The economy has been “improving” for seven years. We’re beginning to wonder how much better it can get!

And yet, the federal funds rate – controlled by the Deep State through its intermediary, the Fed – is still at an emergency level. It sits at a mere half percentage point above zero.

The massive ongoing recovery, as reflected by the federal funds rate…

Leave A Comment