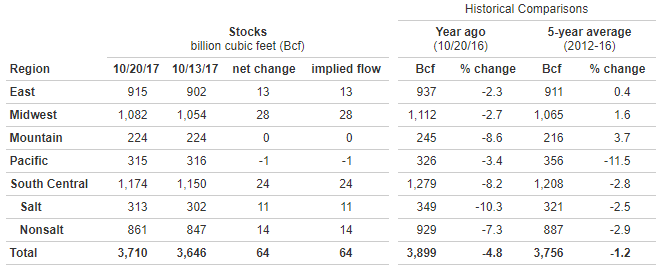

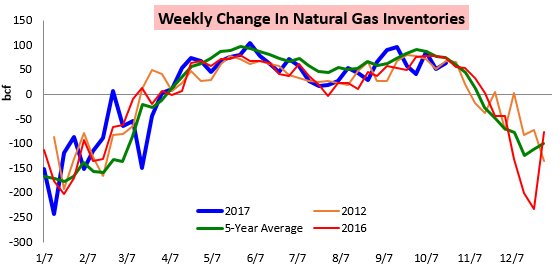

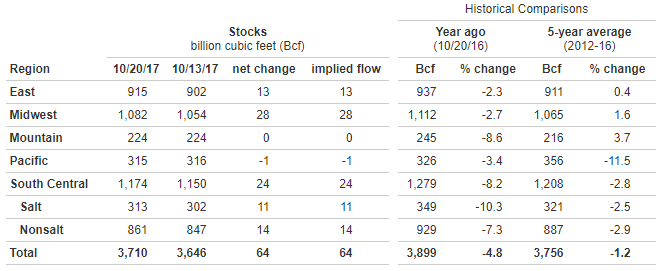

The Energy Information Administration report on natural gas inventories came out today generally in line with expectations, missing our expectation of +66 bcf by just 2 bcf at +64 bcf after hitting our estimate perfectly last week. We see these back-to-back hits as a sign that we have a relatively good handle on current natural gas balances, and the market agreed, not moving much off the print.

This was a tick up from last week, still, and fairly close to both the 5-year average and the print from the same time last year.

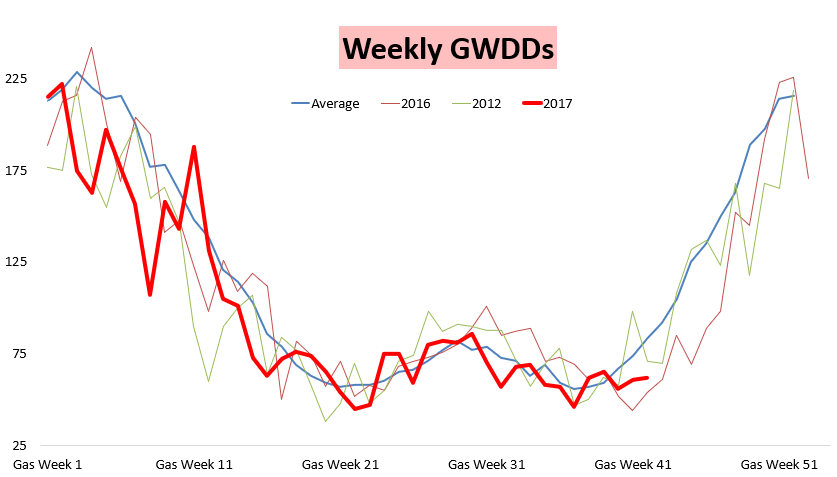

Yet the print was still fairly tight as it came with GWDDs decently below climate averages for week though modestly above last year’s levels.

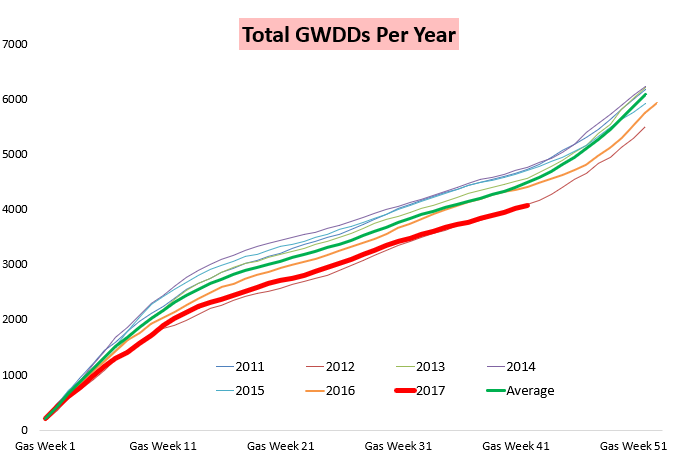

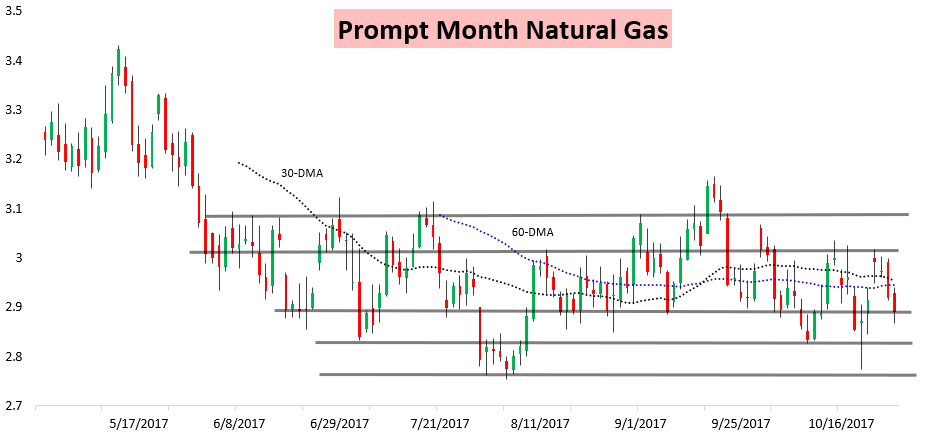

In fact, GWDDs are running far below average through 2017, partially explaining why natural gas prices have struggled to truly break upwards through the year.

Bulls could point to the fact that prices are even trading where they currently are as a sign that, once the weather cooperates for a few months, natural gas prices should be sent significantly higher. Yet weather cooperating has not been the story of this week, with warmer early November forecasts pulling prices back down from their Sunday evening gap.

Every rally in the past six months has been sold into, with prompt month prices struggling to remain sustained above the $3 level for any amount of time. The November contract goes off the board tomorrow as we roll to the December contract, which is currently trading around the $3.05 level. Bulls better hope that weather begins to cooperate more if we are going to see even that contract consistently trade above $3.

Leave A Comment