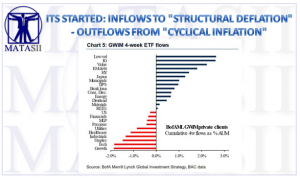

It’s Started: Inflows To “Structural Deflation” — Outflows From “Cyclical Inflation”

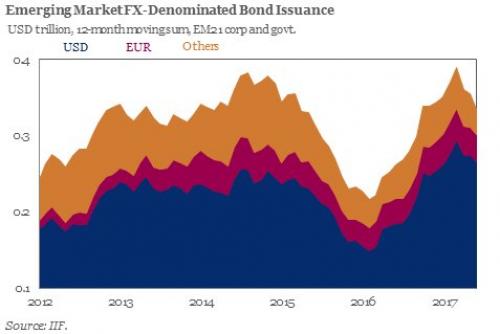

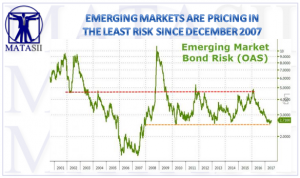

Despite the recent dollar strength (if not so much in the past quarter), dollar bond issuance in Emerging Markets has been on a tear over the past year.

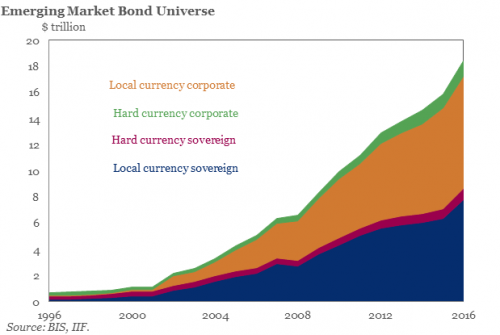

While the EM bond universe has increased by $2.5 trillion to $18.4 trillion since 2016, only 25% of this debt is tradeable via benchmark bond indices.

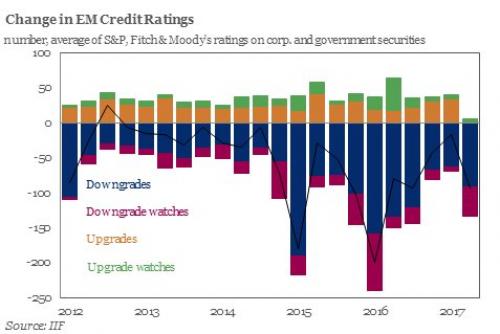

What is more troubling is that despite the relentless foreign portfolio inflows into EM, the credit quality of many emerging markets has deteriorated rapidly in the past year.

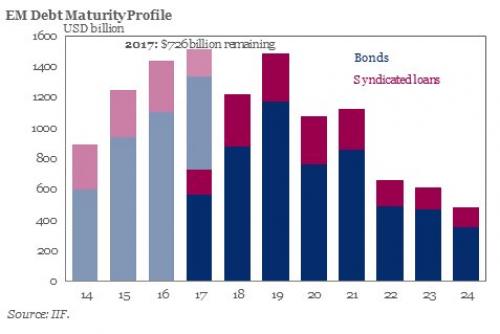

This is an especially acute problem because there is over $1.9 trillion in EM bonds and loans coming due by the end of 2018. Should the EM sector fall out of favor with investors, and if the debt can not be rolled over, it could result in substantial liquidity events across the EM space.

Leave A Comment