Image by Arek Socha sourced from pixabay

It’s no secret that emerging markets (EM) are in a bit of a rough patch. While the unfortunate events in Turkey garnered most of the attention initially, nearly anything related to EM has slid in value. What exactly is going on here? Is this just another acute crisis making its way through the lesser developed regions of the world again? Or have other signals emerged to suggest there to be a larger issue at play? Given the is-ought approach we take on this site, it’s worth digging into some more. After all, a better grasp of what this market driver is—if anything—should better inform us for how we ought to position our portfolios.

While it’s impossible to know with certainty the causes of any given market move, we can nonetheless try to piece together the puzzle. Markets paint like Monet after all; sometimes it’s possible to make out the bigger picture, even if just for a fleeting moment. This may very well be one of those rare occasions.

With the preamble now stated, let’s dig in! Remember though, I’m just a macro-minded novice, so please keep that in mind when reading the following narrative.

I believe that the weakness in EM-related investment markets is indicative of a macro-driven, risk-off move into the U.S. dollar taking place. For all of its faults, the U.S. dollar remains a favored vehicle for expressing a cautious view. There’s a consistency, in my opinion, in how various commodities, currencies (FX), equities and rates have behaved to suggest this. I will lay out my case in the following charts.

The “Chart Storm”

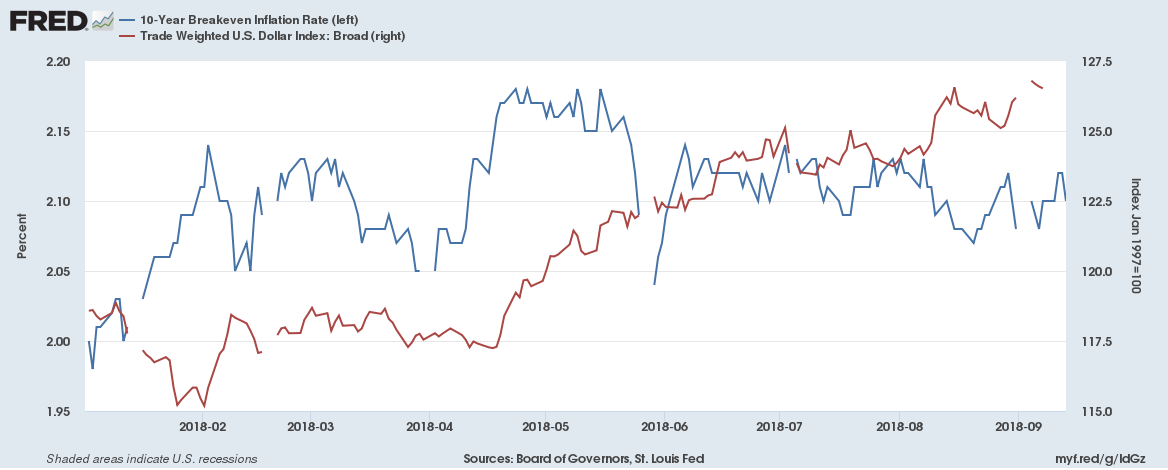

Since April, the U.S. dollar index and S&P 500 have been on a meteoric rise. To be sure, U.S. economic data has been robust, so no surprise there, right? Typically, strong fundamental growth is accompanied by an increase in inflation expectations. Future prices are expected to rise to reflect and balance the growing demand. However, just the opposite has occurred; inflation expectations have fallen. Are market participants positioning for a deflationary move instead?

Both the S&P 500 and DXY index have risen since April. Chart by TradingView

10 year breakeven inflation has been falling since April despite the appreciation of the U.S. dollar. Source: Federal Reserve Bank of St. Louis

Similarly, commodities usually perform well during periods of economic expansion. While not infallible, Dr. Copper is a popular investment meme. However, the asset class is also a favored vehicle for expressing a view on the U.S. dollar, displaying strong negative correlations at times. As shown below, commodity performance has been both weak and broad-based since April, falling in concert with the U.S. dollar’s appreciation. I see this consistency as evidence of a currency trade. Energy (primarily oil) has, however, been an exception. While potentially indicative of a thesis flaw, there are also plausible idiosyncratic reasons for this divergence including production declines in Venezuela and political sanctions on Iran.

Leave A Comment