I began that earlier article with these words:

“OPEC doesn’t stand a chance.

“Since most OPEC nations can pump all the oil and gas they need using first- or second-generation technology, they fail to utilize 4th or 5th generation role technology to decrease their costs. The point, when investing in energy companies, is not to ask merely, “Is the price of oil up or down?” When investing, we are seeking firms that can grow their revenues and their earnings, thus increasing their intrinsic value, through good times and bad. So the more important question to answer is ‘At what point can company A or country X make a reasonable return so that its earnings grow at whatever the current price of oil is?’

“Answering that question for individual companies like those in America, Canada, Australia and much of Europe and the rest of the world, involves determining the price the company receives for its efforts, and beyond that, what its costs are to service its debt, pay its employees, upgrade equipment, etc. For these independent companies, once they have satisfied their creditors and employees, the rest is effectively divided among its shareholders via dividends, buybacks or an increasing stock price…

“But for OPEC nations, which typically have… just one state-owned monolith, the answer is very different. These behemoths exist to provide revenue for the massive welfare states the rulers of these nations have created. [They need more profit in order] to keep their grip on power… lavish largess upon their cronies, and provide food, fuel and other subsidies to their restive subjects in order to keep them in line.”

These state monopoly producers might be able to “pump” oil at a lower cost but the price they need to stay in power far exceeds what independent oil and gas companies need to pay their bills and keep their shareholders happy. And, thanks to OPEC, private companies have cut their cost of production by up to 50% (!) since I wrote the original article 2 years ago. This is a tsunami that OPEC cannot hold back.

Non-governmental producers of oil and gas, especially in the US and Canada, have only to satisfy their shareholders, not the entire welfare state. (Except for ridiculously high taxes, of course, but that’s a subject for a different article!)

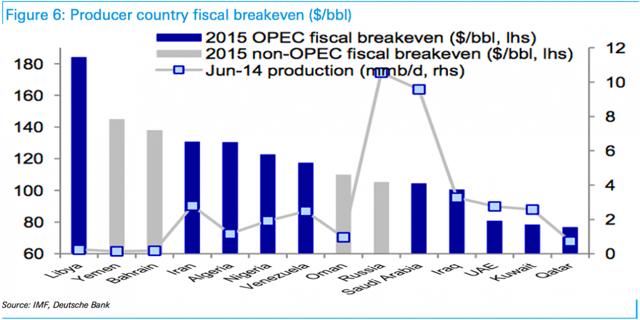

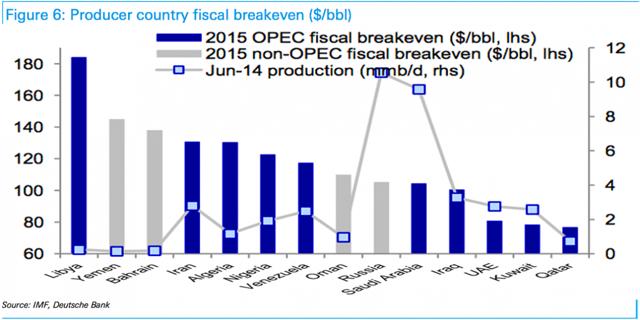

Here is what governments with state-owned monopolies need the price of oil to be in order to balance their budgets. Saudi Arabia may be able to extract oil for $7 a barrel, but they need it to sell for roughly $100 a barrel in order to break even after paying off the royal family, the cronies, the bureaucrats and, via massive subsidies, a restive populace.

(click to enlarge)

OPEC is whistling past their own graveyard. Their level of naïveté dooms some, their arrogance the others. And now, after the much-feted “agreement” of November 30, they face the possibility (likelihood) that almost all of them will agree to one thing but will do another.

Leave A Comment