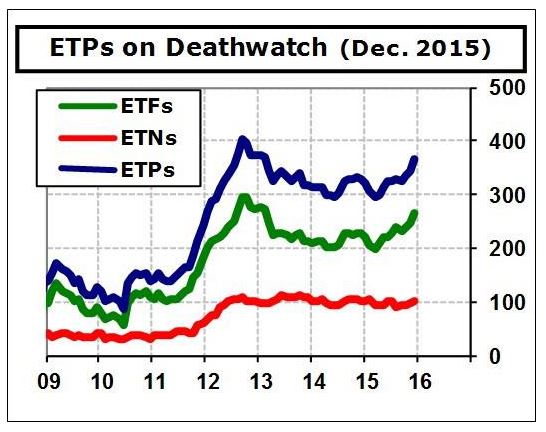

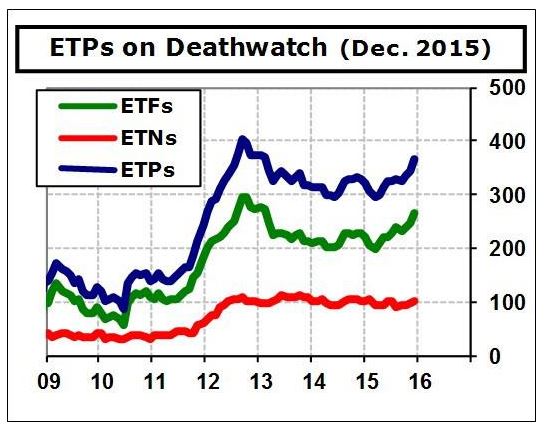

The quantity of ETFs and ETNs on Deathwatch jumped by 23 for December. There were 28 additions and only five removals. Of those coming off, three were the result of improved health, while the other two were closed, delisted, and liquidated. The net increase pushes the membership count to a 35-month high of 366, consisting of 266 ETFs and 100 ETNs.

Heading up the new arrivals are the two AccuShares ETFs, which are now more than six months old, making them eligible for Deathwatch. These two ETFs attempt to track the spot price of the VIX Volatility Index and fail miserably at doing so. They are teeter-totter ETFs, constructed much like the ill-fated MacroShares. As such, they were doomed from the start. But AccuShares added new twists that made them even worse than MacroShares in my opinion.

AccuShares introduced the concept of “Corrective Distributions” that try to keep the demand for “up” shares in balance with the “down” shares. However, these distributions were both numerous and large, quickly depleting their asset bases. To overcome this, the funds made distributions of offsetting shares two months in a row: The owners of AccuShares Spot CBOE VIX Up (VXUP) received a “Corrective Distribution” of one share of AccuShares Spot CBOE VIX Down (VXDN), and owners of VXDN received a share of VXUP. It is almost impossible to bet on the direction of the VIX when offsetting positions are forced into your account.

So far, the VXUP has made per-share distributions of $44.67 plus two shares of VXDN. Owners of VXDN have received $15.12 and two shares of VXUP (it’s a vicious circle). Between all the distributions, reverse splits, and offsetting shares, performance is nearly impossible to determine, and they do not even attempt to do so on the website. These products need to close before anyone else gets hurt.

Leave A Comment