It looks like the ETF industry is under the gun. Securities and Exchange Commission officials held a meeting of the Investor Advisory Committee in Washington, D.C. on Thursday, and began to lay out the case for reform in the ETF industry. In specific, SEC Commissioner Luis Aguilar outlined the kind of questions they’re asking in their inquiry regarding the rapidly-growing exchange-traded funds market.

Questions about the ETF industry began to emerge after August 24th, an extremely volatile trading day and he worst session for U.S. stocks in four years. August 24th witnessed multiple halts in both stocks and ETFs, stoppages that short-circuited the arbitrage mechanism of ETFs and led to ETF prices plunging well below the indexes they’re designed to track for a short period of time. The major glitch in the system was a painful lesson for investors and has brought regulators attention to a number of problems with overlapping market rules implemented following the 2010 “flash crash”.

Statement from SEC Commissioner Aguilar about ETFs

Commissioner Aguilar did not beat around the bush in his speech at the SEC committee meeting. He made his agenda clear in his introduction: “Why ETFs proved so fragile that morning raises many questions, and suggests that it may be time to reexamine the entire ETF ecosystem.”

In his remarks, Aguilar raised four general questions about the events of August 24th.

1) Should ETFs have industry-specific volatility curbs? Do so-called limit up/limit down volatility bands need to be updated? Should market-wide circuit breakers factor in the number of securities that are currently halted?

2) Should rules for “clearly erroneous” trades be reformed?

3) What roles should exchanges have in ETF trading?

4) How can market makers be more incentivized to stay in the market during times of extreme volatility?

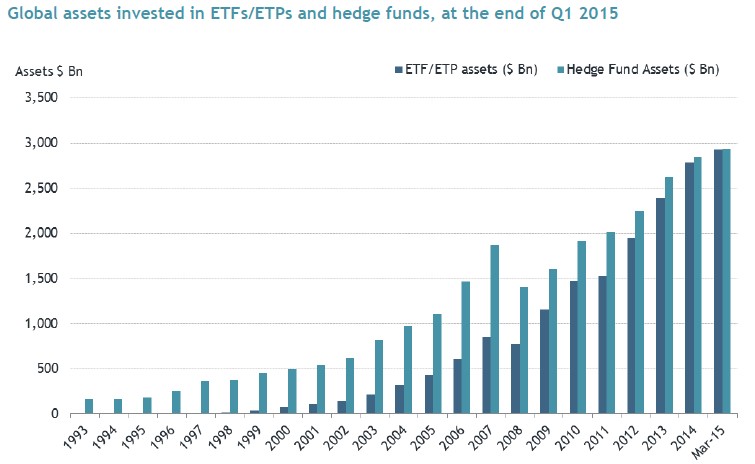

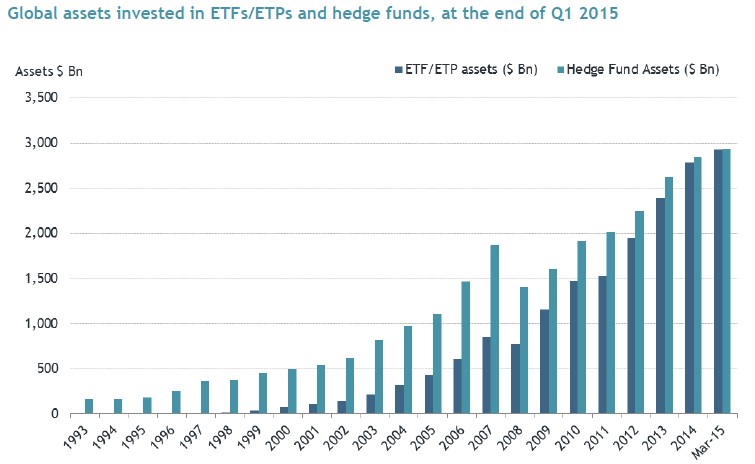

Democratic SEC Commissioner Aguilar also went on to argue that the commission needed to ask bigger, even existential questions about the ETF industry and its very rapid growth, including the issue of whether the growth needed to be curtailed. Here, he outlined four general areas for consideration:

Leave A Comment