Overnight in Asia the biggest news were concerning the JPY. BOJ held off on more QE despite more soft inflation and consumption data. USDJPY was very volatile after the decision, as the pair fell 60 pips and then rose to 121.10 ahead of the news. In Europe, EURUSD rose to 1.1015 briefly ahead of EU consumer price index and unemployment data.

Yesterday, US GDP numbers showed that economy expanded at 1, 5% versus 1, 6% expected. As a result the USD was under some pressure as these numbers don’t really justify a rate hike in December. US stocks closed the day lower as a result of the news. Meanwhile GOLD is still under immense pressure since its sell off 2 days ago. The metal posted new lows at $1146.

For today, key economic news include EU and US inflation numbers as well as US Confidence numbers. It is the last trading day of the month, so month end flows might also influence market prices. Have a great month!

Trading Quote of the Day:

“A great trader is like a great athlete. You have to have natural skills, but you have to train yourself how to use them.”

Marty Schwartz

Green lines are resistance, Red lines are support

EUR/USD

Pivot: 1.1

Likely scenario: Short positions below 1.1 with targets @ 1.0895 & 1.084 in extension.

Alternative scenario: Above 1.1 look for further upside with 1.105 & 1.11 as targets.

Comment: The RSI is mixed to bearish.

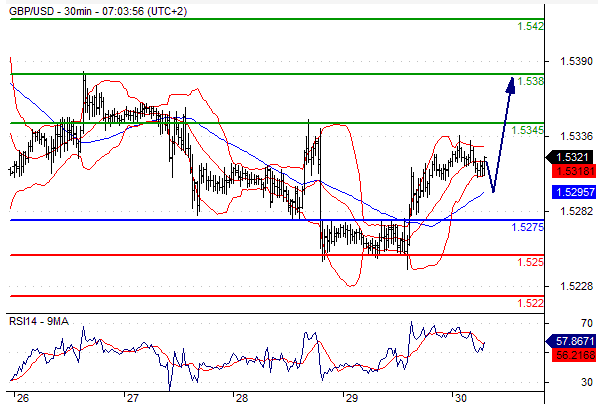

GBP/USD

Pivot: 1.5275

Likely scenario: Long positions above 1.5275 with targets @ 1.5345 & 1.538 in extension.

Alternative scenario: Below 1.5275 look for further downside with 1.525 & 1.522 as targets.

Comment: The RSI is well directed.

AUD/USD

Pivot: 0.712

Likely scenario: Short positions below 0.712 with targets @ 0.705 & 0.7015 in extension.

Alternative scenario: Above 0.712 look for further upside with 0.716 & 0.72 as targets.

USD/JPY

Pivot: 120.55

Likely scenario: Long positions above 120.55 with targets @ 121.5 & 121.75 in extension.

Alternative scenario: Below 120.55 look for further downside with 120.15 & 119.95 as targets.

Comment: The RSI is well directed.

Leave A Comment