Asian stocks fell early on Wednesday as risk appetite was hurt following unfolding events in Europe. A bomb scare led to an international friendly match between Germany and the Netherlands being canceled, whilst gunfire in a French suburb, as special forces launched an operation to catch one of the suspects in connection with Friday’s events also sparked fresh fears over further attacks.

As a result, markets have been slightly subdued although USD strength remains, as an expected December rate hike by the Fed remains on track. Gold continues its slippery slide having broken through a key support level (1077) and is currently trading at 1070.50 at time of writing, perhaps paving the way for further downside towards 1000.

Oil in the meantime has recoverd slightly and is up just above $42 following Monday’s $40.05 low although as long as it remains below the $42.25 resistance line, further downside is expected.

Today, we have a quiet calendar in Europe. From the US later today we have building permits and FOMC meeting minutes to look out for.

Trading quote of the day: “Beginners focus on analysis, but professionals operate in a three dimensional space. They are aware of trading psychology their own feelings and the mass psychology of the markets.” – Alexander Elder

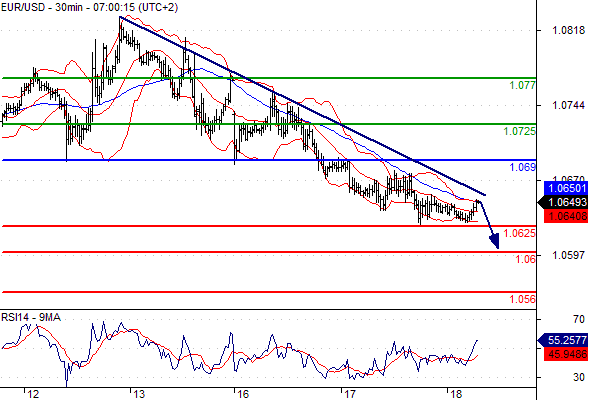

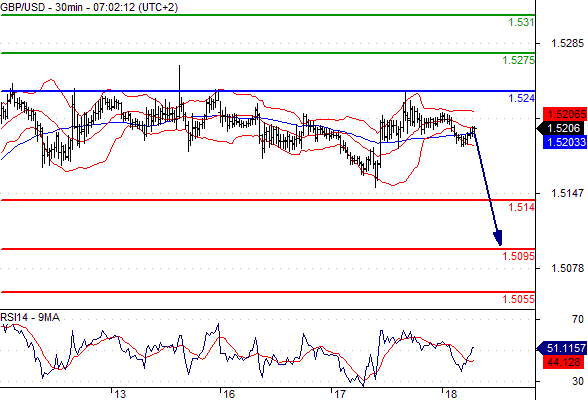

Green lines are resistance, Red lines are support.

EUR/USD

Pivot: 1.069

Likely scenario: Short positions below 1.069 with targets @ 1.0625 & 1.06 in extension.

Alternative scenario: Above 1.069 look for further upside with 1.0725 & 1.077 as targets.

Comment: The RSI lacks upward momentum.

GBP/USD

Pivot: 1.524

Likely scenario: Short positions below 1.524 with targets @ 1.514 & 1.5095 in extension.

Alternative scenario: Above 1.524 look for further upside with 1.5275 & 1.531 as targets.

Comment: The RSI lacks upward momentum.

AUD/USD

Pivot: 0.707

Likely scenario: Long positions above 0.707 with targets @ 0.715 & 0.717 in extension.

Alternative scenario: Below 0.707 look for further downside with 0.704 & 0.7015 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Leave A Comment