EU Session Bullet Report

NFP numbers dissapointed on Friday raising concerns that the global slowdown may be taking its toll on the US economy. Despite the lower than expected numbers, unemployment did fall to its lowest level in more than 5 years providing some light at the end of the tunnel.

US stocks closed lower as the NFP gave little comfort to investors seeking direction as to what the Fed will do with interest rates.

This morning in Asia, trading has been subdued with no significant movers as the uncertaintly continues . The US and Canada enjoy a public holiday today and calendar wise, very little news.

Trading quote of the day:

“Have no fear of perfection – you’ll never reach it.”

– Salvador Dalí

EURUSD

Pivot: 1.1115

Likely scenario: Long positions above 1.1115 with targets @ 1.121 & 1.126 in extension.

Alternative scenario: Below 1.1115 look for further downside with 1.1085 & 1.105 as targets.

Comment: The RSI lacks downward momentum.

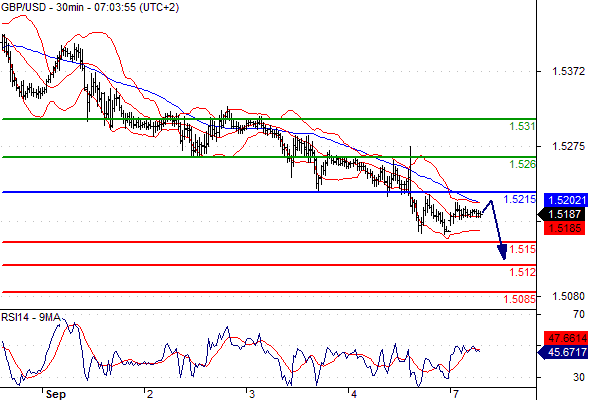

GBPUSD

Pivot: 1.5215

Likely scenario: Short positions below 1.5215 with targets @ 1.515 & 1.512 in extension.

Alternative scenario: Above 1.5215 look for further upside with 1.526 & 1.531 as targets.

Comment: As long as 1.5215 is resistance, look for choppy price action with a bearish bias.

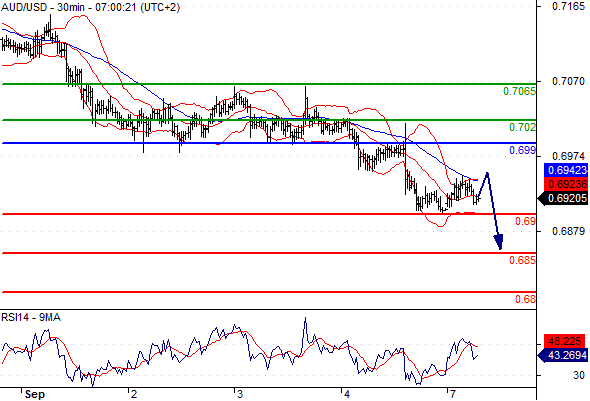

AUDUSD

Pivot: 0.699

Likely scenario: Short positions below 0.699 with targets @ 0.69 & 0.685 in extension.

Alternative scenario: Above 0.699 look for further upside with 0.702 & 0.7065 as targets.

Comment: As long as 0.699 is resistance, look for choppy price action with a bearish bias.

USDJPY

Pivot: 119.7

Likely scenario: Short positions below 119.7 with targets @ 118.55 & 117.8 in extension.

Alternative scenario: Above 119.7 look for further upside with 120.2 & 120.65 as targets.

Comment: The upward potential is likely to be limited by the resistance at 119.7.

USDCAD

Pivot: 1.322

Likely scenario: Long positions above 1.322 with targets @ 1.329 & 1.3325 in extension.

Alternative scenario: Below 1.322 look for further downside with 1.3175 & 1.313 as targets.

Comment: The RSI is mixed to bullish

Leave A Comment