Good morning. So will it be economic gloom, doom or boom. The FOMC today begins its most anticipated meeting in 5 years, ahead of its interest rate announcement tomorrow.

The worlds financial markets have regressed into limbo as choppy, range bound markets, do little to boost investor confidence. To illustrate the current uncertainty, yesterday’s German ZEW economic sentiment had literally no impact on the markets despite coming out significantly lower at 12.1 versus 18.3 expected.

The FED finds itself in a dilemma as there are so many variables to consider. The U.S economy is most definitely advancing in a positive manner and recent months data points towards a rate hike. On the other hand, there is the global growth concerns to consider and the possible knock on effect to the U.S.

Raising interest rates could result in a stronger dollar which in turn may impact on exports. Not raising interest rates, could be viewed as acknowledgement that all is not well, which may cause panic and volatility in the financial markets.

What is certain, the next 2 days will be extremely exciting and traders should maintain their accounts with sufficient equity to take advantage of market moves and protect open positions.

News wise today, watch out for Claimant Count Change and Average Earnings from the U.K at 08:30 GMT and Inflation data from the EZ at 09:00 GMT. Later in the U.S session we have CPI at 12:30 GMT.

Trading quote of the day:

“Everyone has the brainpower to follow the stock market. If you made it through fifth-grade math, you can do it.”

– Peter Lynch

EURUSD

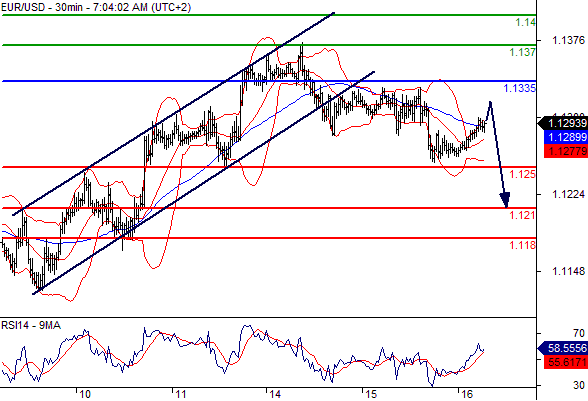

Pivot: 1.1335

Likely scenario: Short positions below 1.1335 with targets @ 1.125 & 1.121 in extension.

Alternative scenario: Above 1.1335 look for further upside with 1.137 & 1.14 as targets.

Comment: Even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

GBPUSD

Pivot: 1.5395

Likely scenario: Short positions below 1.5395 with targets @ 1.529 & 1.525 in extension.

Alternative scenario: Above 1.5395 look for further upside with 1.545 & 1.55 as targets.

Comment: As long as 1.5395 is resistance, look for choppy price action with a bearish bias.

Leave A Comment