US stocks halted a five day slide yesterday recovering slightly, however, on-going concerns show little signs of halting the global selloff.

In Asia this morning, stocks also recovered slightly from yesterdays multi year lows, but around the world, stock markets are set for their worst performing quarter since 2011.

EURUSD & USDJPY remain unpredictable as market uncertainty continues to keep them in a range.

News wise today, German unemployement at 07:55 GMT, UK Q2 GDP at 08:30 GMT and Eurozone unemployment at 09:00 GMT are the highlight during the morning. Later this afternoon we have ADP employment change from the US at 12:15 GMT and Crude Oil inventories at 14:30 GMT so we can expect some market movement.

This evening at 19:00 GMT, Fed chair Janet Yellen is set to speak, as investors and traders alike eagerly tune in hoping for some positive talk that will stabilize global markets.

Trading quote of the day:

A man should look for what is, and not for what he thinks should be.

Albert Einstein.

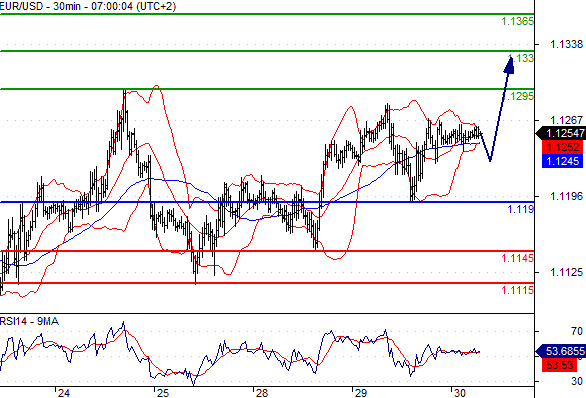

EURUSD

Pivot: 1.119

Likely scenario: Long positions above 1.119 with targets @ 1.1295 & 1.133 in extension.

Alternative scenario: Below 1.119 look for further downside with 1.1145 & 1.1115 as targets.

Comment: The RSI is mixed to bullish.

Trade Now

GBPUSD

Pivot: 1.521

Likely scenario: Short positions below 1.521 with targets @ 1.513 & 1.509 in extension.

Alternative scenario: Above 1.521 look for further upside with 1.5245 & 1.5285 as targets.

Comment: A break below 1.513 would trigger a drop towards 1.509.

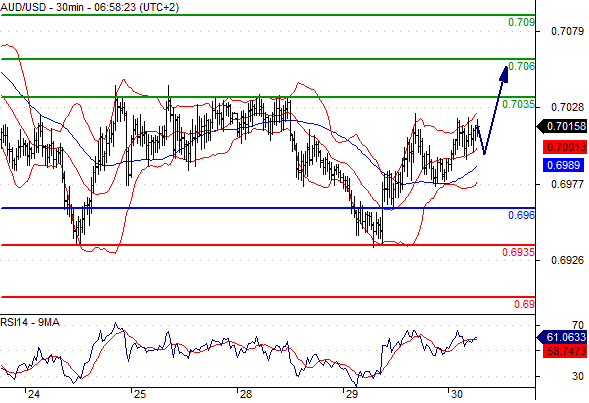

AUDUSD

Pivot: 0.696

Likely scenario: Long positions above 0.696 with targets @ 0.7035 & 0.706 in extension.

Alternative scenario: Below 0.696 look for further downside with 0.6935 & 0.69 as targets.

Comment: The RSI is well directed.

USDJPY

Pivot: 119.5

Likely scenario: Long positions above 119.5 with targets @ 120.15 & 120.45 in extension.

Alternative scenario: Below 119.5 look for further downside with 119.2 & 119 as targets.

Comment: The pair has broken above the upper boundary of a bearish channel and remains on the upside.

Leave A Comment