EU Session Bullet Report – Oil recovers slightly as GOLD rises to 1080

Markets continue trading in tight ranges due to the limited volatility attributed to the festive season. As yesterday it was the official calendar beginning of winter, Oil (+0.64%) managed to edge higher on speculation the winter season will drive up demand. As a result the drop of commodity prices (CAD mostly) was halted and USDCAD dropped from its multi-year highs posted earlier, but still in an upward trend. EURUSD advanced to 1.0938, its highest since the FED meeting last week, a move which could be attributed also to GOLDS rise to 1080 from 1050 2 days ago. Overall, amid thin trading conditions the market can turn very unpredictable as end of year flows and portfolio readjustment may cause sudden big moves with no real fundamental reasons behind them. US GDP and Housing Data are the most noteworthy news today but impact is expected to be limited.

Trading quote of the day: What seems too high and risky to the majority generally goes higher and what seems low and cheap generally goes lower. – William O’Neil

Green lines are resistance, Red lines are support.

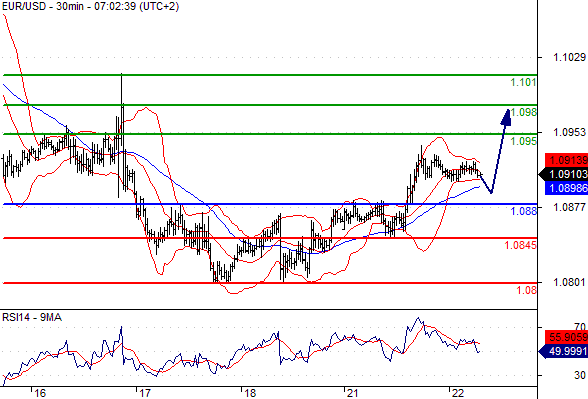

EUR/USD

Pivot: 1.088

Likely scenario: long positions above 1.088 with targets @ 1.095 & 1.098 in extension.

Alternative scenario: below 1.088 look for further downside with 1.0845 & 1.08 as targets.

Comment: the RSI lacks downward momentum.

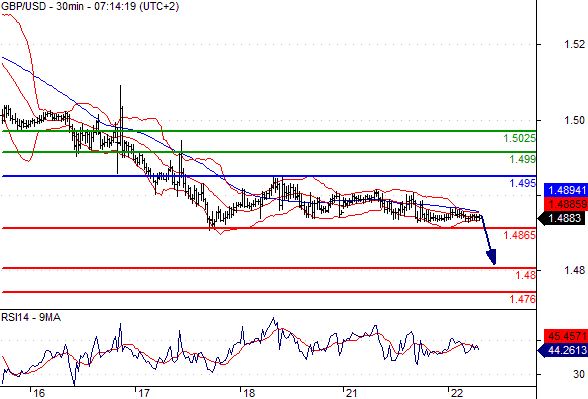

GBP/USD

Pivot: 1.495

Likely scenario: short positions below 1.495 with targets @ 1.4865 & 1.48 in extension.

Alternative scenario: above 1.495 look for further upside with 1.499 & 1.5025 as targets.

Comment: the RSI is mixed to bearish.

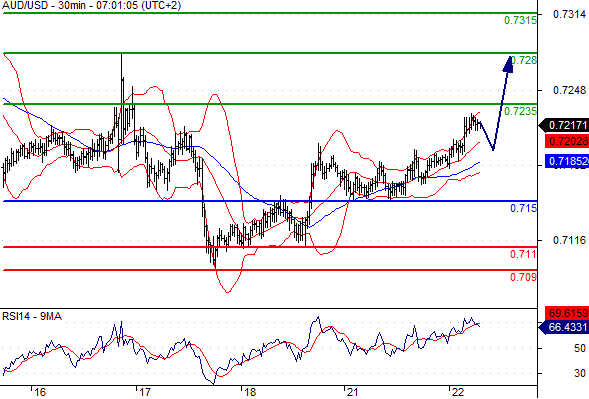

AUD/USD

Pivot: 0.715

Likely scenario: long positions above 0.715 with targets @ 0.7235 & 0.728 in extension.

Alternative scenario: below 0.715 look for further downside with 0.711 & 0.709 as targets.

Comment: the RSI is well directed.

USD/JPY

Pivot: 121.75

Likely scenario: short positions below 121.75 with targets @ 120.85 & 120.55 in extension.

Alternative scenario: above 121.75 look for further upside with 122.15 & 122.6 as targets.

Comment: as long as 121.75 is resistance, look for choppy price action with a bearish bias.

Leave A Comment