EU Session Bullet Report

Market focus is on BoE and the GBPUSD today. Bank of England meets to announce its interest rate decision, the inflation report and reveal the Banks minutes from the last meeting. GBPUSD is currently trading cautiously ahead of this important event. The pair has an immediate resistance at 1.5400/05 (round number/ 1h 50-SMA), above which 1.5442/50 (100-DMA/ psychological levels) would be tested.

After the relatively hawkish statement from the 28 October FOMC meeting and not least the fairly upbeat comments on the US economy from Jannet Yellen yesterday, today’s long list of speeches from FOMC member S.Fisher, Dudley, Tarullo and Lockhart will be watched closely.

Yesterday, hawkish comments from Fed members and upbeat economic data sparked a USD rally across the board. Gold hit a new monthly low at 1106 while EURUSD followed suit posting 1.0835 lows.

Trading Quote of the day:

Its better to lose your opinion, than to lose your money.

Green lines are resistance, Red lines are support

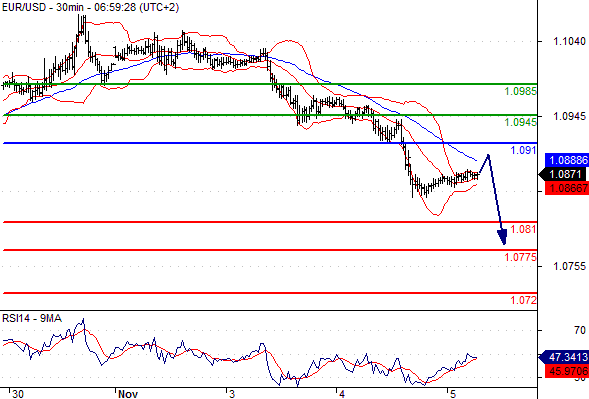

EUR/USD

Pivot: 1.091

Likely scenario: Short positions below 1.091 with targets @ 1.081 & 1.0775 in extension.

Alternative scenario: Above 1.091 look for further upside with 1.0945 & 1.0985 as targets.

Comment: The RSI is mixed to bearish.

GBP/USD

Pivot: 1.541

Likely scenario: Short positions below 1.541 with targets @ 1.5355 & 1.5305 in extension.

Alternative scenario: Above 1.541 look for further upside with 1.545 & 1.55 as targets.

Comment: The RSI is mixed to bearish.

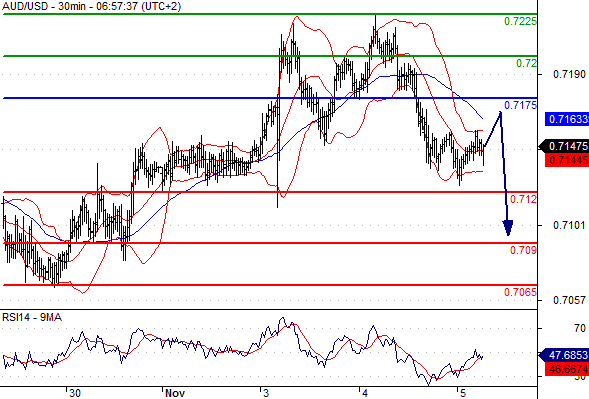

AUD/USD

Pivot: 0.7175

Likely scenario: Short positions below 0.7175 with targets @ 0.712 & 0.709 in extension.

Alternative scenario: Above 0.7175 look for further upside with 0.72 & 0.7225 as targets.

Comment: As long as 0.7175 is resistance, look for choppy price action with a bearish bias.

USD/JPY

Pivot: 121.1

Likely scenario: Long positions above 121.1 with targets @ 121.8 & 122 in extension.

Alternative scenario: Below 121.1 look for further downside with 120.9 & 120.55 as targets.

Comment: Even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

Leave A Comment