As debate continues over the path of US rate hikes through 2016, USD positioning is relatively neutral for the time as attention turns towards next weeks FOMC meeting. BNP Paribas expects the FED to lift rates by 25bp and thinks current FX levels are attractive for long USD positions.

In Asia this morning, stock markets are set for sizeable weekly losses as China’s Yuan plunged to almost a 4.5 year low. Tumbling crude oil prices and low demand continue to raise concerns over the regions economies with energy stocks suffering as a result.

EUR/USD’s modest recovery following last weeks ECB action seems to have slowed as USD strengthened yesterday with the pair back trading below 1.0950 at time of writing. In the UK, as expected there was no change in monetary policy regarding its interest rates, halting Cables strong gains from Wednesday and is now trading just below 1.5150.

Gold recent volatility seems to have subsided, albeit temporarily and is currently trading around the 1070 mark. Oil remains most under pressure, trading just above $36.50 but with talk amongst leading analysts of oil possibly reaching $20, further downside cannot be ruled out.

This morning is light on the news side although the afternoon should provide for some interesting opportunities as the US releases PPI and Retail Sales data at 13.30 GMT.

Trading quote of the day:

Amateurs want to be right. Professionals want to make money.

Alan Greenspan

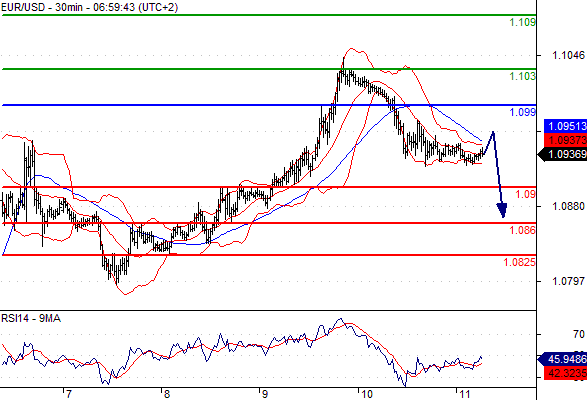

Green lines are resistance, Red lines are support.

EUR/USD

Pivot: 1.099

Likely scenario: short positions below 1.099 with targets @ 1.09 & 1.086 in extension.

Alternative scenario: above 1.099 look for further upside with 1.103 & 1.109 as targets.

Comment: the RSI is mixed to bearish.

GBP/USD

Pivot: 1.511

Likely scenario: long positions above 1.511 with targets @ 1.52 & 1.5245 in extension.

Alternative scenario: below 1.511 look for further downside with 1.5075 & 1.5035 as targets.

Comment: a support base at 1.511 has formed and has allowed for a temporary stabilization.

Leave A Comment