The Dollar has traded in a tight range versus most currencies after last Friday’s solid NFP data. With little news in the calendar this period, investors will keep an eye on the ECB December 3 meeting. Overnight, US and Asian stock markets also moved broadly sideways following last month’s strong rally. GBP/USD was the only pair making a significant advance yesterday, supported by better than expected jobs data in the UK. AUD/USD is also rising though, after solid employment data as well. The pair jumped from 0.7063 to 0.7140 after data revealed the addition of 58k jobs Vs 15k expected.

Today we have jobless claims highlighting news in the US, however we will also hear 3 FED members talk today. The content is likely to confirm the justification of interest rate hike in December. Aside for the US FED members, ECB President Mario Draghi testifies today in the European Parliament.

Trading quote of the day:

“The policy of being too cautious is the greatest risk of all.”

– J. Nehru

Green lines are resistance, Red lines are support.

EUR/USD

Pivot: 1.079

Likely scenario: Short positions below 1.079 with targets @ 1.0705 & 1.067 in extension.

Alternative scenario: Above 1.079 look for further upside with 1.083 & 1.086 as targets.

Comment: As long as 1.079 is resistance, look for choppy price action with a bearish bias.

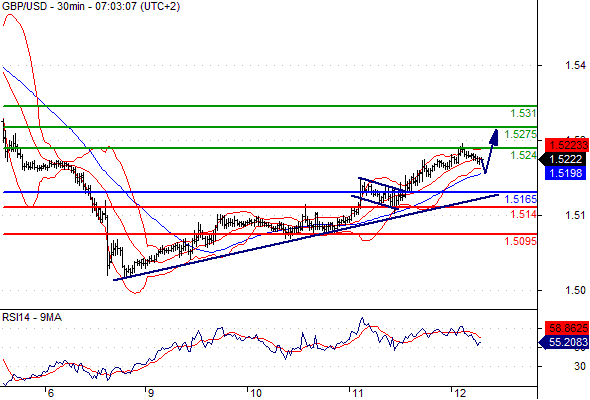

GBP/USD

Pivot: 1.5165

Likely scenario: Long positions above 1.5165 with targets @ 1.524 & 1.5275 in extension.

Alternative scenario: Below 1.5165 look for further downside with 1.514 & 1.5095 as targets.

Comment: The pair has validated a bullish flag.

AUD/USD

Pivot: 0.707

Likely scenario: Long positions above 0.707 with targets @ 0.717 & 0.7195 in extension.

Alternative scenario: Below 0.707 look for further downside with 0.704 & 0.7015 as targets.

Comment: The RSI is well directed.

USD/JPY

Pivot: 122.65

Likely scenario: Long positions above 122.65 with targets @ 123.2 & 123.6 in extension.

Alternative scenario: Below 122.65 look for further downside with 122 & 121.6 as targets.

Comment: The RSI is mixed to bullish.

Leave A Comment