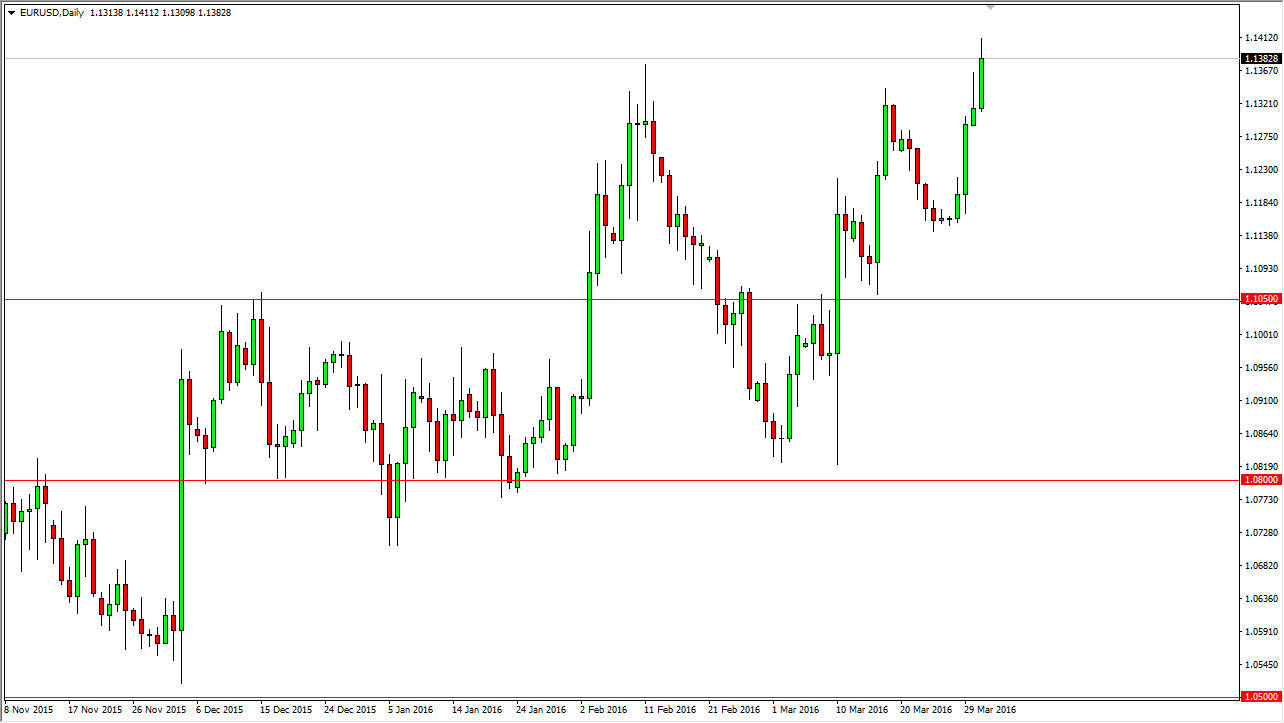

EUR/USD

The Euro rose during the course of the session on Thursday, breaking above the top of the shooting star from the Wednesday session, sending this market looking towards the 1.14 level. Any pullback at this point in time should be thought of as value. We could very well get that pullback though, based upon the fact that we have the Nonfarm Payroll Numbers out of the US. I would anticipate that the market will be fairly quiet until we get those numbers, so any drift lower should set up a nice value play. Any pullback from the number would also be a nice value play. Alternately though, if we can break above the top of the range for the session on Thursday would be reason enough to start buying as well. I do have a target of the 1.15 level above.

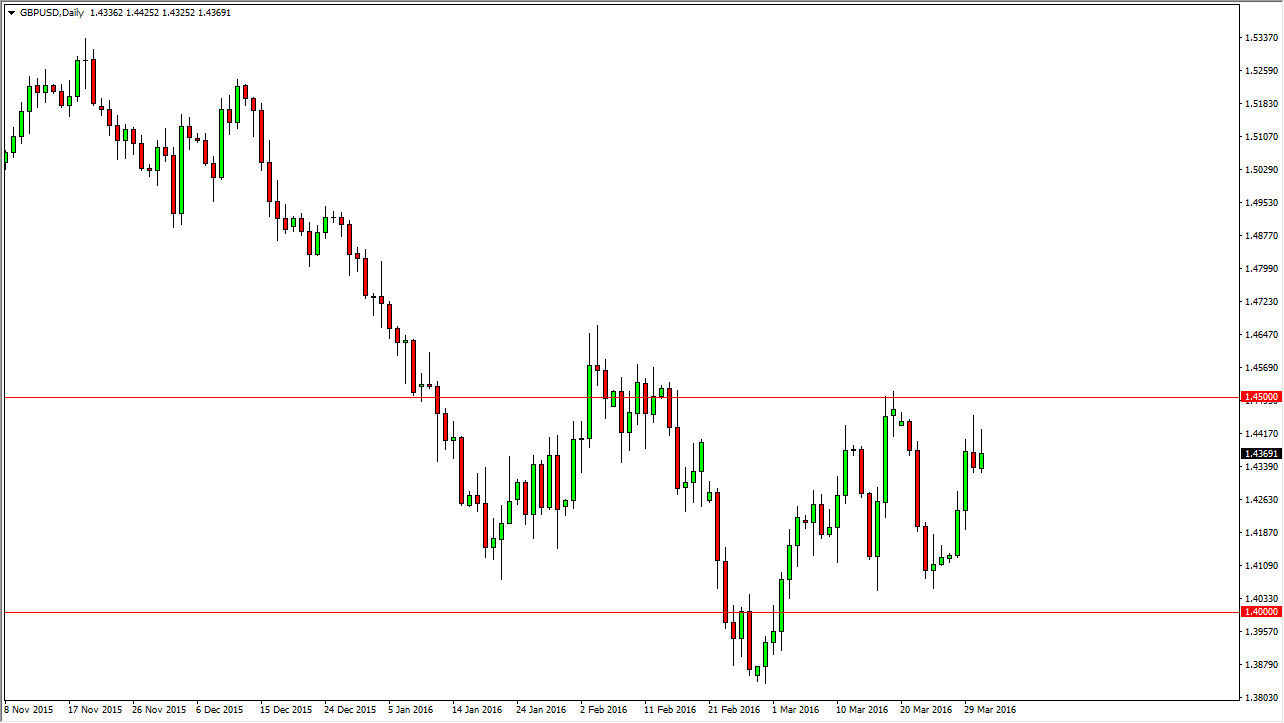

GBP/USD

The GBP/USD pair initially tried to rally during the course of the session on Thursday, but turned right back around to form a shooting star. The shooting star was preceded by the shooting star from the Wednesday session, so that means that the market is starting to run into quite a bit of resistance. It’s not much to imagine though, because quite frankly we have seen quite a bit of resistance near the 1.44 level extending all the way to the 1.45 level as well. If we can break down below the pair of shooting stars, I believe that this market will simply continue to consolidate and reach down towards the 1.41 level yet again.

The Federal Reserve is likely to step away from at least a couple of interest-rate hikes for the year 2016, so it’s likely that the US dollar will struggle because of it. But at the same time, we have the European Union question when it comes to the United Kingdom. If they leave, that could punch the Pound as well. In other words, confusion reigns and I believe we stay within the consolidation region.

Leave A Comment