EUR/USD

The EUR/USD pair went back and forth during the course of the session on Friday, as the nonfarm numbers didn’t quite get to where we were expecting. At the end of the day though, I look at this as a market that has quite a bit of support at the 1.1050 level below, and that means that we will have buyers when we pullback. I have no intention in shorting this market, but I do recognize that it is going to be a fight to get to the 1.15 level above which I see as the next major resistance barrier. At this point time, I don’t really have a scenario in which I want to sell this market, and as a result I just simply look for signs of increased buying pressure.

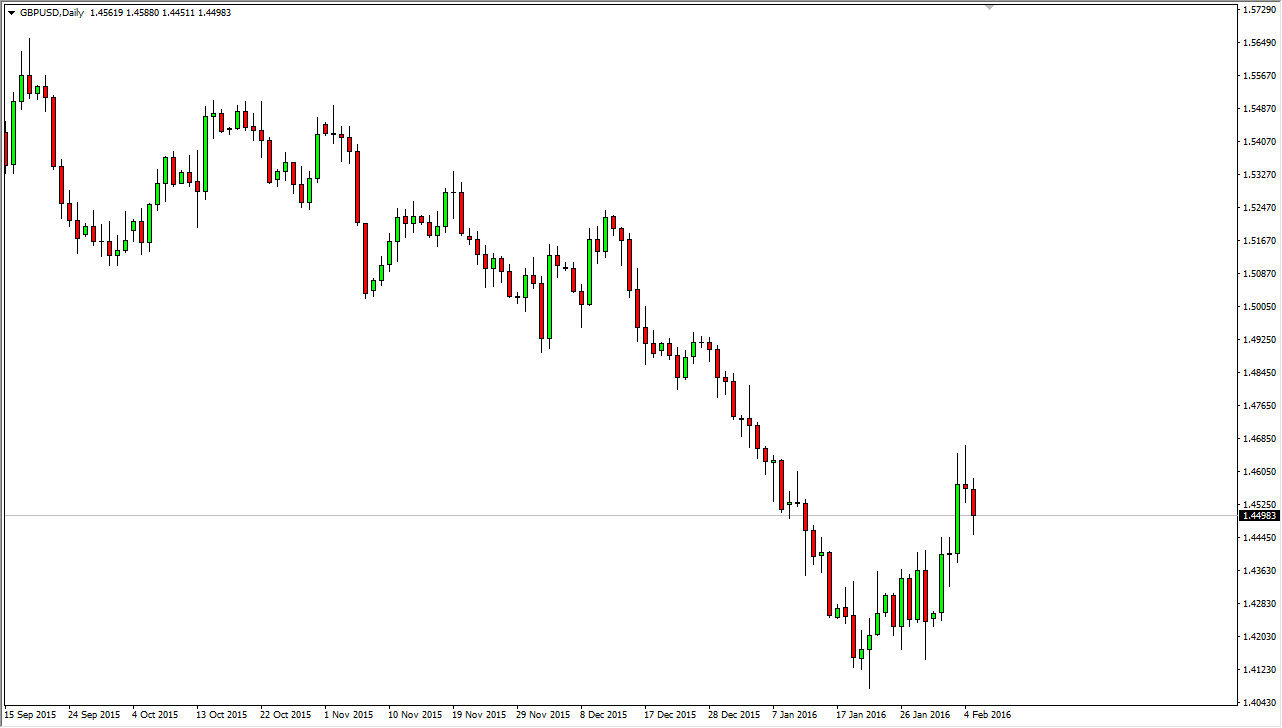

GBP/USD

The British pound fell during the session on Friday, breaking the bottom of the shooting star from the previous session. With that being the case, it looks like we are getting continue to go little bit lower, but there could be a significant amount of support underneath to cause bounces from time to time. Ultimately, this is a market that I feel goes lower over the longer term, but it could be short-term volatile at this point in time.

On the other hand, if we break above the top the shooting star from the Thursday session, I feel that the British pound goes much higher and probably goes towards 1.48, and then eventually the 1.50 level. I have no interest in buying this market until we break above that shooting star, and believe that short-term selling opportunities will present themselves again and again on signs of exhaustion. This is a market that should continue to favor the US dollar in general as there is a lot of economic uncertainty out there, and of course we have had such a negative trend for quite some time.

Leave A Comment