EUR/USD

The EUR/USD pair initially rallied during the day on Wednesday but found enough resistance of the 1.13 level to turn around and form a massive shooting star. Ultimately, this has a lot to do with the Federal Reserve announcement and they’re sticking to their guns as far the interest rate increases are concerned, which I believe that the markets were working against. Now that we have this, I think the pullback is probably coming but we still are stuck in the consolidation area between the 1.15 level and the 1.05 level below. Because of this, I think that we will eventually try to reach the 1.15 handle, but over the next couple of sessions I would not be surprised at all to see some type of pullback, but longer term I think that the buyers will return, but if we can break down from here, it’s likely that we could try to go all the way down to the gap below.

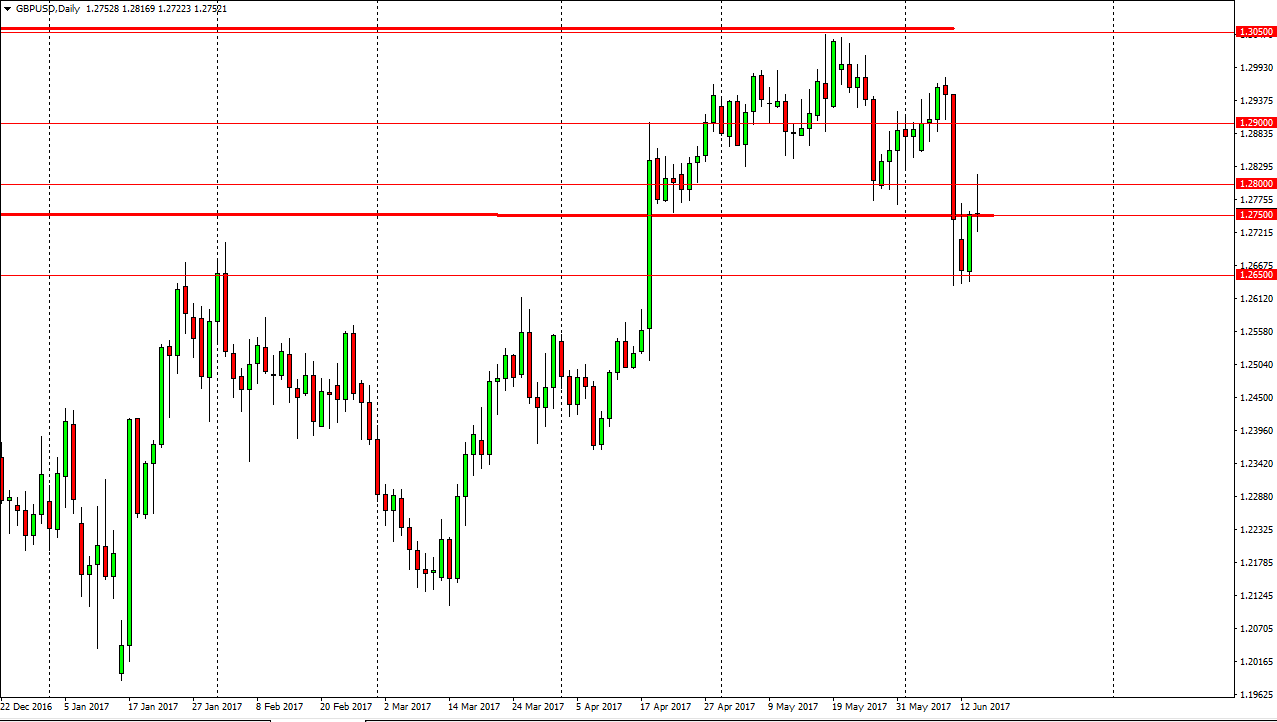

GBP/USD

The British pound initially tried to rally and even broke above the 1.28 handle at one point during the day. However, the market turned around and formed a massive shooting star after the Federal Reserve had it statement. That being the case, the 1.2750 level he comes even more crucial than it had previously been. If we breakdown below the bottom of the range for the day, the market should then go down to the 1.2650 level. That’s an area that was massively supportive, and I think we are going to go back down there, but if we breakdown below the lows of the last several sessions, I think the market will have much farther to fall. The Bank of England has an interest rate announcement and a statement later today, so having said that I believe that the market will be paying quite a bit of attention to that and then placing a trade.

Leave A Comment