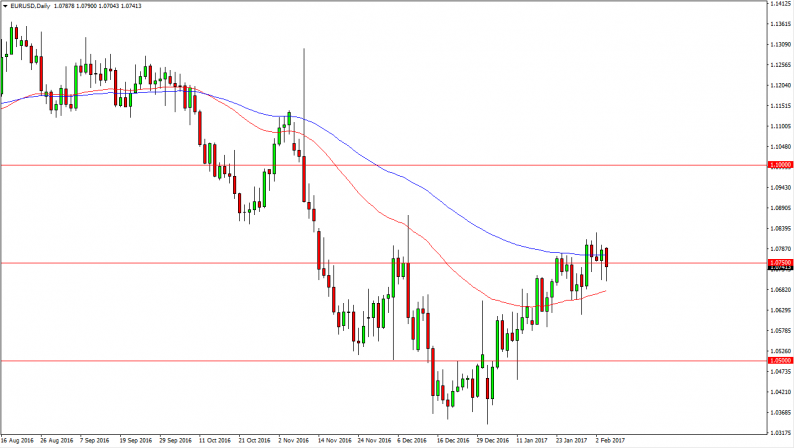

EUR/USD

The EUR/USD pair had a negative session on Monday, but continues to find support just below at the 50-day exponential moving average, or at least just above it. The 100-day exponential moving average was broken initially during the day, but continues to offer a bit of resistance. The 1.075 level looks like a bit of a magnet when it comes to this pair, and with this in mind I believe that we will continue to chop around in a short-term type of trading environment. Because of this, I’m going to avoid the pair, but I think once we break above the Thursday shooting star, or break below the 50-day exponential moving average, clarity will return to the market and I will be able to follow either signal.

GBP/USD

The British pound initially fell on Monday, reaching towards the 1.24 level. We found plenty of support there so the market turned around to form a hammer, and that of course is a bullish sign. A break above the top of a hammer and more importantly the 1.25 handle, we should then reach towards the 1.27 level above. This is a market that will more than likely consolidate back and forth in this area, so I believe the buyers are about to step in and take control the market again. If we can break down below the 1.24 level, then the sellers will probably drive the pair down to the 1.2250 level. In that area, we should see quite a bit of support, but at this point, I believe that if we can break above the 1.25 level, there will be a flood of bullish pressure.

I still believe that there is a solid chance that the British pound has formed the bottom. Because of this, expect a lot of volatility as trend changes cause quite a bit in the way of choppiness.

Leave A Comment