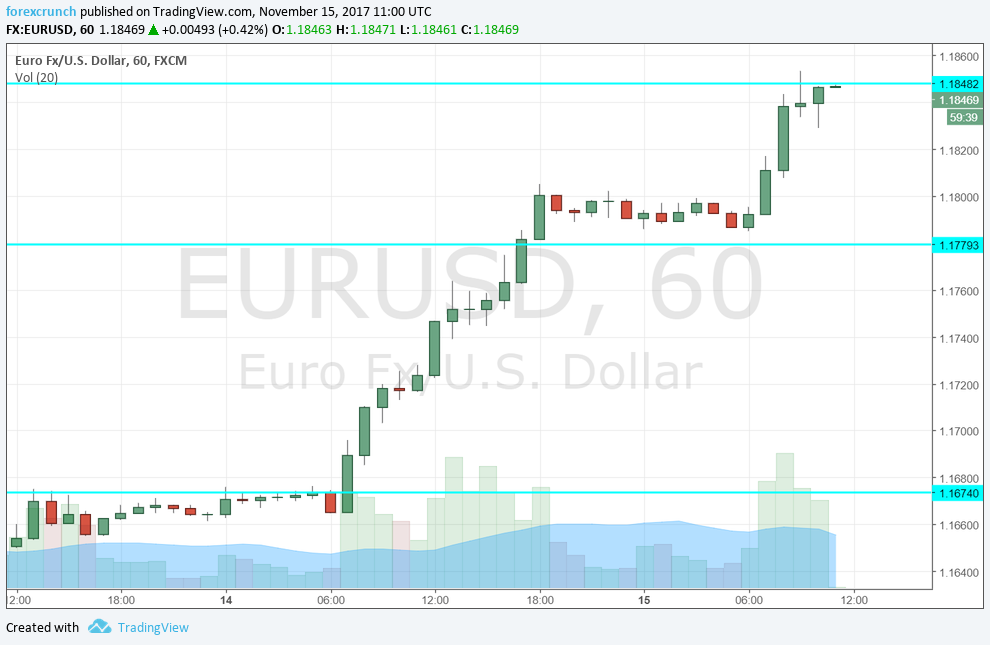

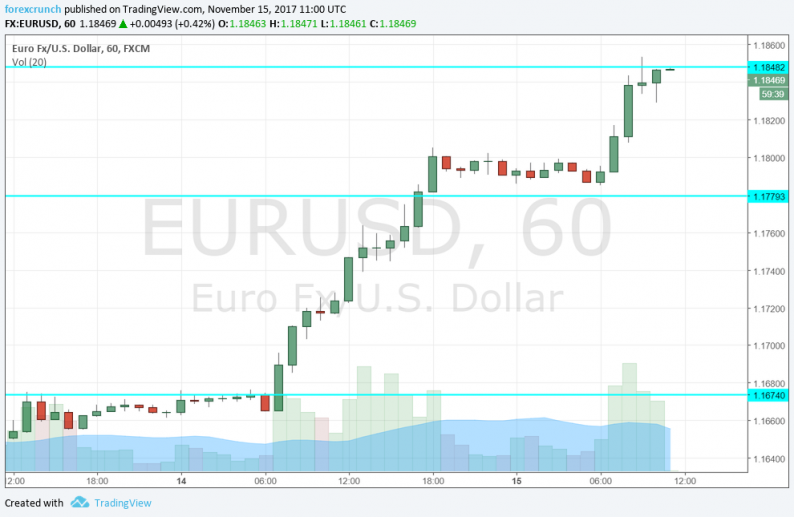

EUR/USD is trading around 1.1840, just under the 1.1850 resistance line. It had earlier conquered the 1.1780 level and settled there for a while before moving forward. And before that, euro/dollar was struggling with 1.1670 before making the clear break. All in all, EUR/USD is not only making a big move to the upside, but also presenting impressive technical behavior.

The move began yesterday with the publication of Germany’s GDP. The locomotive of the euro-zone seems to be firing on all cylinders, with a growth rate of 0.8% q/q in Q3. That is equivalent to around 3.2% annualized, better than the US.

Yet the euro also seems to enjoy a “risk off” atmosphere. The sell-off in global stocks boosts the Japanese yen, first and foremost, but the euro does not lag too far behind. Back in 2015, the single currency also enjoyed a similar status, rising on Greek issues and dropping when an agreement was reached. The absurd of the phenomenon was apparent, and it didn’t last that long. Maybe we are witnessing that again.

Here is how things look on the chart:

Leave A Comment