When nothing happens, EUR/USD rises. Why? The euro-zone enjoys a wide trade balance surplus, mostly thanks to the German export machine. The US has a significant trade deficit. So, the flows of importers and exporters lead to net euro buys and net dollars sales.

Needless to say, forex trading is not only about exchanges of importers and exporters but mostly about speculation: changes to interest rates, money printing programs, economic developments, political developments, etc.

Yet this time of the year, between Christmas and New Year’s Day, is not dominated by any economic publications of importance and luckily no big political events. So, the natural flows do their work.

EUR/USD levels to watch

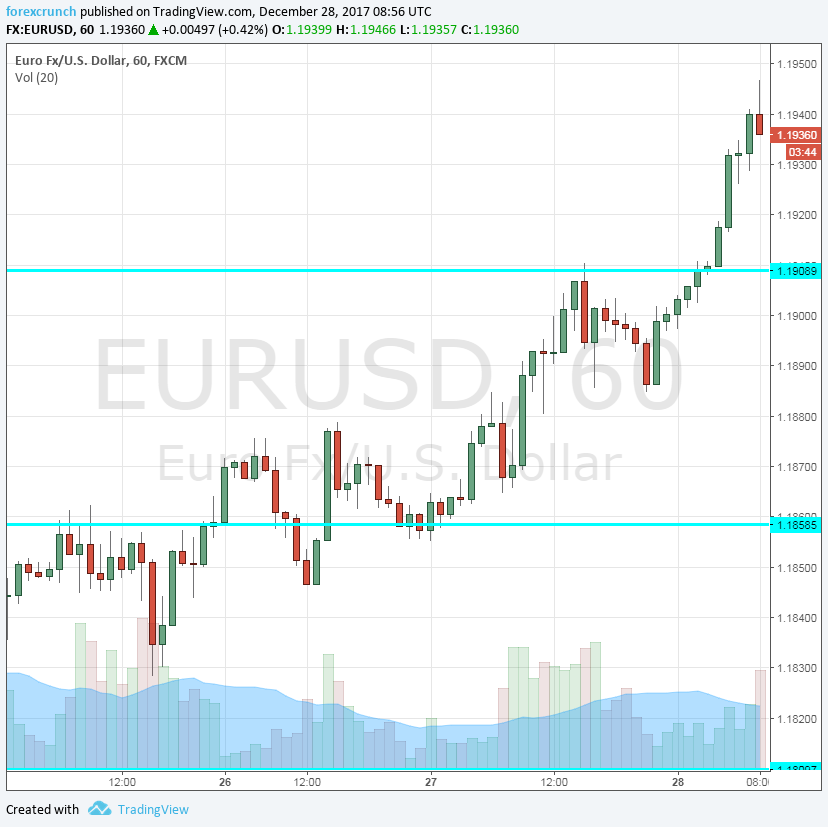

EUR/USD is currently some 50 pips higher on the day, trading just under 1.1940. This is a break above the resistance line at 1.1910. The next level to watch out for is 1.20, the round number that the pair had already topped earlier in the year. The 2017 high of 1.2090 is the next barrier.

On the downside, we find 1.1910 as support followed by 1.1860 and 1.1810.

All in all, these flows could continue supporting euro/dollar in the dying days of 2017. What’s in store for 2018? That will depend on many other factors, but the pair may continue higher. The good news is already factored into the USD: tax cuts and perhaps further rate hikes. This may change with Powell. And the euro? Currently, the end of QE in September 2018 is not in sight and a signal that bond purchases may end could boost the common currency.

Here is the EUR/USD chart:

Leave A Comment