EUR/USD had a turbulent week that it eventually ended slightly lower and it is still looking for a new direction. The upcoming week features a speech by Draghi, final inflation figures, and more. What’s next for EUR/USD? Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

While Germany will finally have a government, Italy’s elections ended with an inconclusive outcome that initially weighed on the euro. The ECB decided to remove its open door to increasing the size of its QE programming, initially sending the euro higher, but Draghi then downplayed the change by saying there was no change to the outlook and that the change only confirms the previous assessments. Falls in industrial output, that joined weaker PMIs caused speculation that the euro-zone economic growth has peaked. The US gained 313K jobs but wages slowed down to 2.6%, below expectations and pushing the greenback lower. The breakthrough in talks with North Korea weakened the dollar and the yen while Trump’s tariffs initially hurt the greenback but when they were watered down, they allowed for a recovery. All in all, a very busy week with many moving parts.

Updates

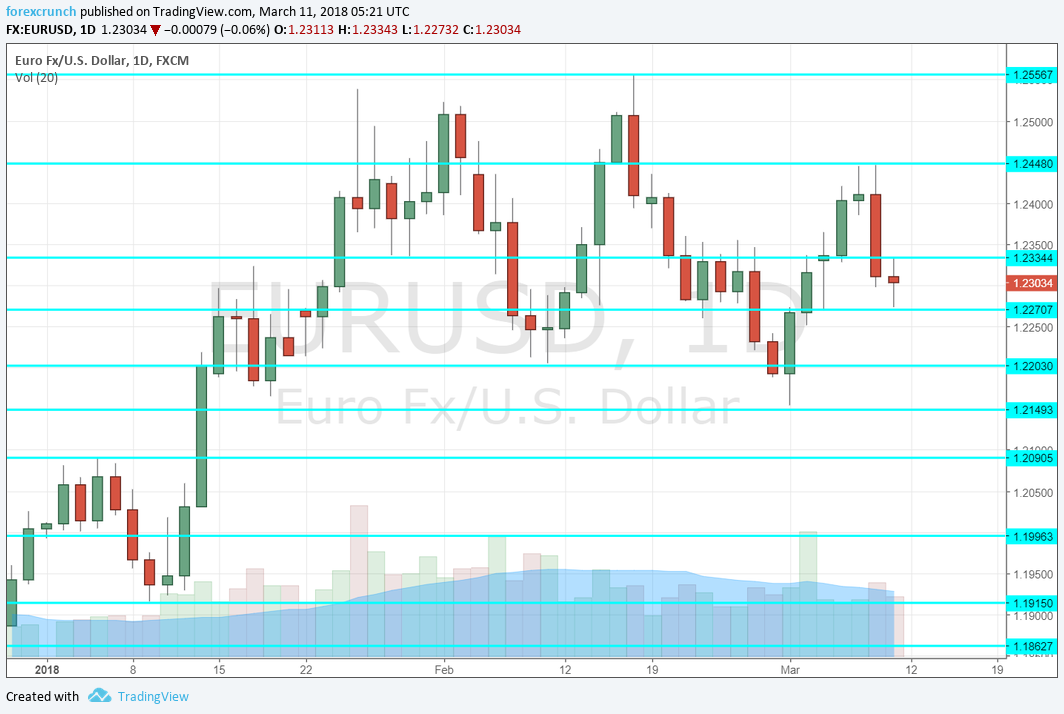

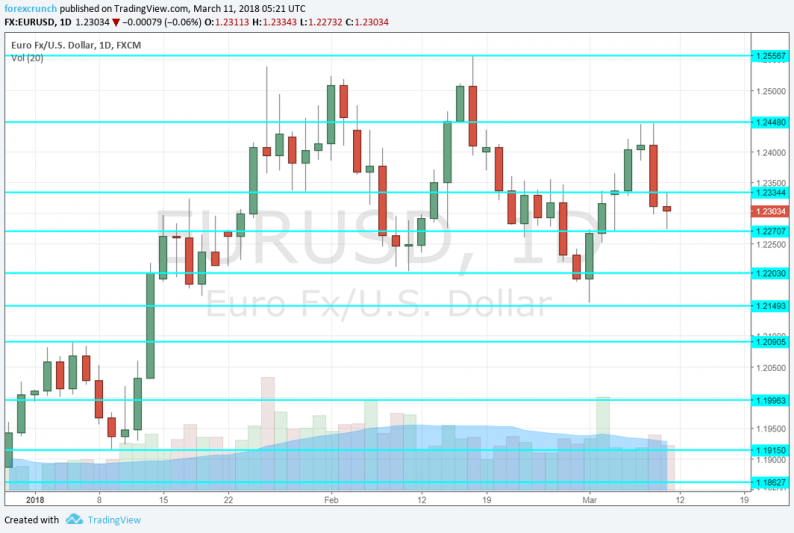

EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

Leave A Comment