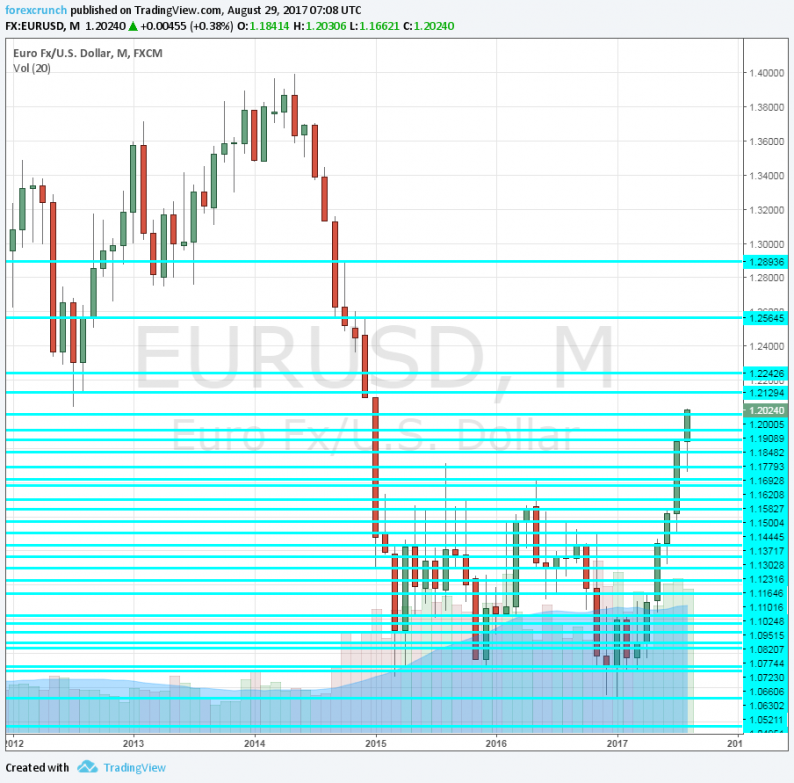

It finally happens. After rising very gradually towards the very ground level, the world’s most popular currency pair made a decisive breakout and reached a new high of 1.2020. Update: the pair extends its gains and reaches 1.2036, very close to the “whatever it takes” level of July 2012.

This is the highest level since January 2015, when the ECB announced its massive 1 trillion euro QE program. Since then, the pair hit a high of 1.1712 in 2015 and 1.1620 in 2016. The pair has an excellent 2017 so far, reaching new highs. This high level seemed like a tough nut to crack. Not anymore.

Nevertheless, the Jackson Hole Symposium on Friday provided excuses to buy the pair. Fed Chair Janet Yellen did not repeat the Fed’s intention to raise rates. This was enough for markets to resume the sell-off. And Draghi did not talk down the euro, as some had expected. Will he talk the euro down now?

The ECB makes its decision on September 7th, but markets are not waiting.

The euro is also gaining ground against the pound, with EUR/GBP hitting 0.9285. However, it is also important to note that the US dollar is slightly weaker.

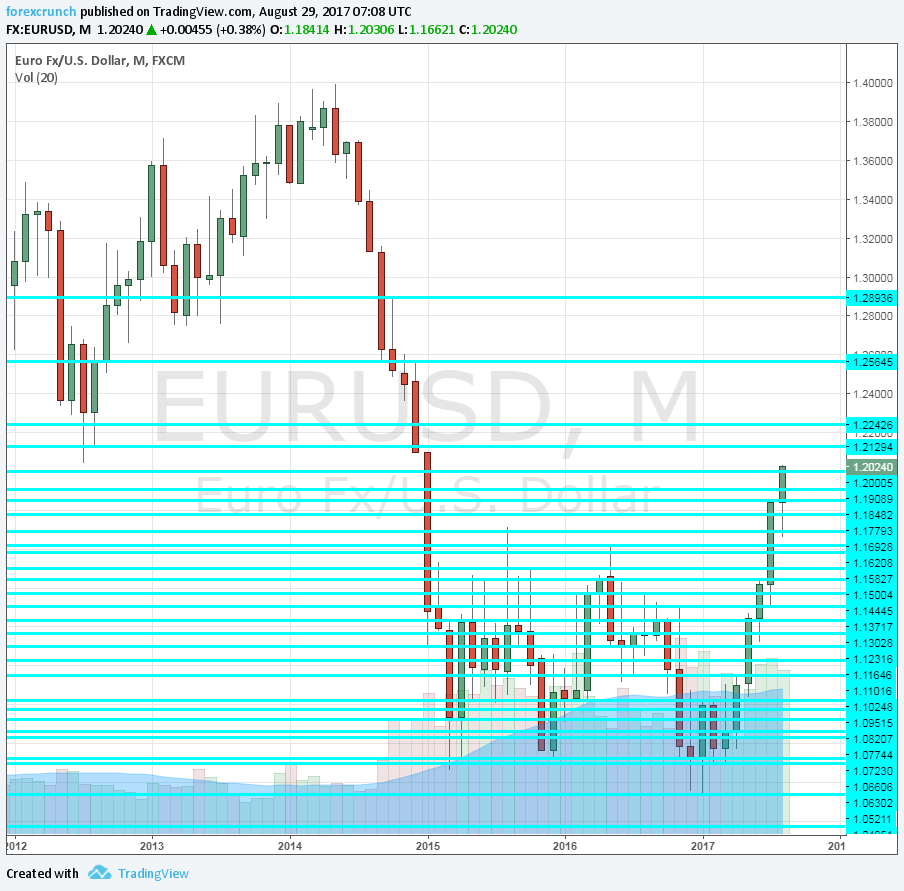

EUR/USD levels above 1.20

The next level to watch is 1.2040, the low seen in 2012, just before Draghi made his famous “whatever it takes” speech that sent the pair to higher ground.

Further above, we find 1.2130 was the low level in August 2012. Higher, 1.2240 provided support beforehand.

Even higher, 1.25 is a round number that is eyed by many. The following line is 1.2565, a high recorded late 2014. Support awaits at 1.1870 and 1.1710.

Here is the monthly EUR/USD chart that reflects these levels:

And here is the one-hour chart showing the big breakout.

Leave A Comment