The EUR/USD is trading just under 1.1700 once again, similar to the levels seen earlier in the week but above the ranges seen last week.

China announced retaliatory tariffs against the US, on $60 billion worth of US imports, far below the duties on $200 billion of Chinese imports to the US that the Administration announced. More importantly for markets, Beijing said they would not devalue the yuan as part of the trade spat with the US. The announcement helped improve the atmosphere. On the other hand, the world’s second-largest economy continues trimming its holding of US Treasuries, a trend that indirectly pushes the greenback

Earlier, markets were consoled by the fact that the US imposed a tariff of only 10% on these products. The level is expected to rise to 25% at the end of the year, but in between the US holds its mid-term elections and everything can change after the vote.

Further comments on the tariffs may continue moving markets today. Another theme is the rise in US bond yields. The benchmark 10-year yields surpassed the 3% level on Tuesday and continued moving up, providing support to the US Dollar.

The US publishes Building Permits, and Housing Starts at 12:30. Both housing figures will need to move in the same direction to see a meaningful response.

More importantly for the EUR/USD, Mario Draghi is due to deliver a speech on the future of economic policy in Berlin at 13:00. The President of the European Central Bank spoke on Tuesday but did not touch on any market-moving theme.

All in all, the market mood remains stable after the trade announcements by the US and China. The calm weighs on the USD, but higher yields stabilize the greenback.

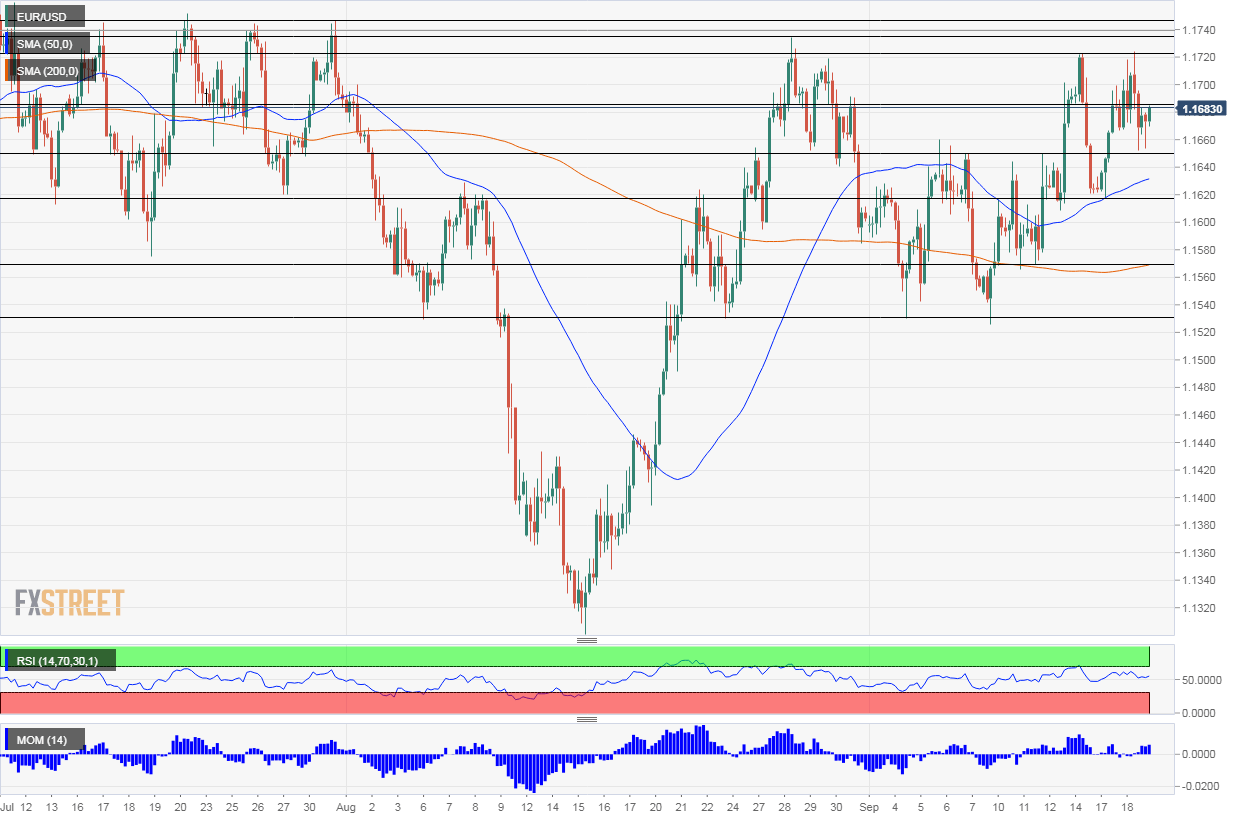

EUR/USD Technical Analysis

The EUR/USD continues trading above the 50 and 200 Simple Moving Averages on the four-hour chart. Also, Momentum is now positive. These are all bullish signs. The Relative Strength Index is not going anywhere fast though.

Leave A Comment