The EUR/USD is trading above 1.1500, significantly higher than in Monday’s morning trade but below the fresh highs of 1.1542. US President Donald Trump sent the US Dollar down by commenting on the Fed’s policy once again. He criticized the central bank for raising rates and said he will continue doing so. He expressed his disappointment that Powell is not a “cheap money man” and criticized the EU and China for manipulating their currencies.

The US Dollar reacted with a downfall that extended beyond the immediate impact. Will the Fed react and move to a more dovish policy? Or will they fiercely defend their independence? Markets are still trying to make up their minds, and this may explain the hesitance of the pair to the upside.

Another reason for the current consolidation is the expectation that the European Central Bank’s Meeting Minutes, coming out on Thursday, will remain dovish. In the recent meeting, President Mario Draghi clarified that the Bank will not raise rates before September 2019. It will be interesting to hear their tone about trade relations.

Another factor that causes concern is the global trade. While China and the US are talking, the US is still moving forward with levies worth $16 billion of Chinese goods. There are no indications that the this has been frozen.

On Monday, Germany’s central bank, the Bundesbank, said it expects slightly slower growth for Q3 after a robust Q2. There are no market-moving events planned for today.

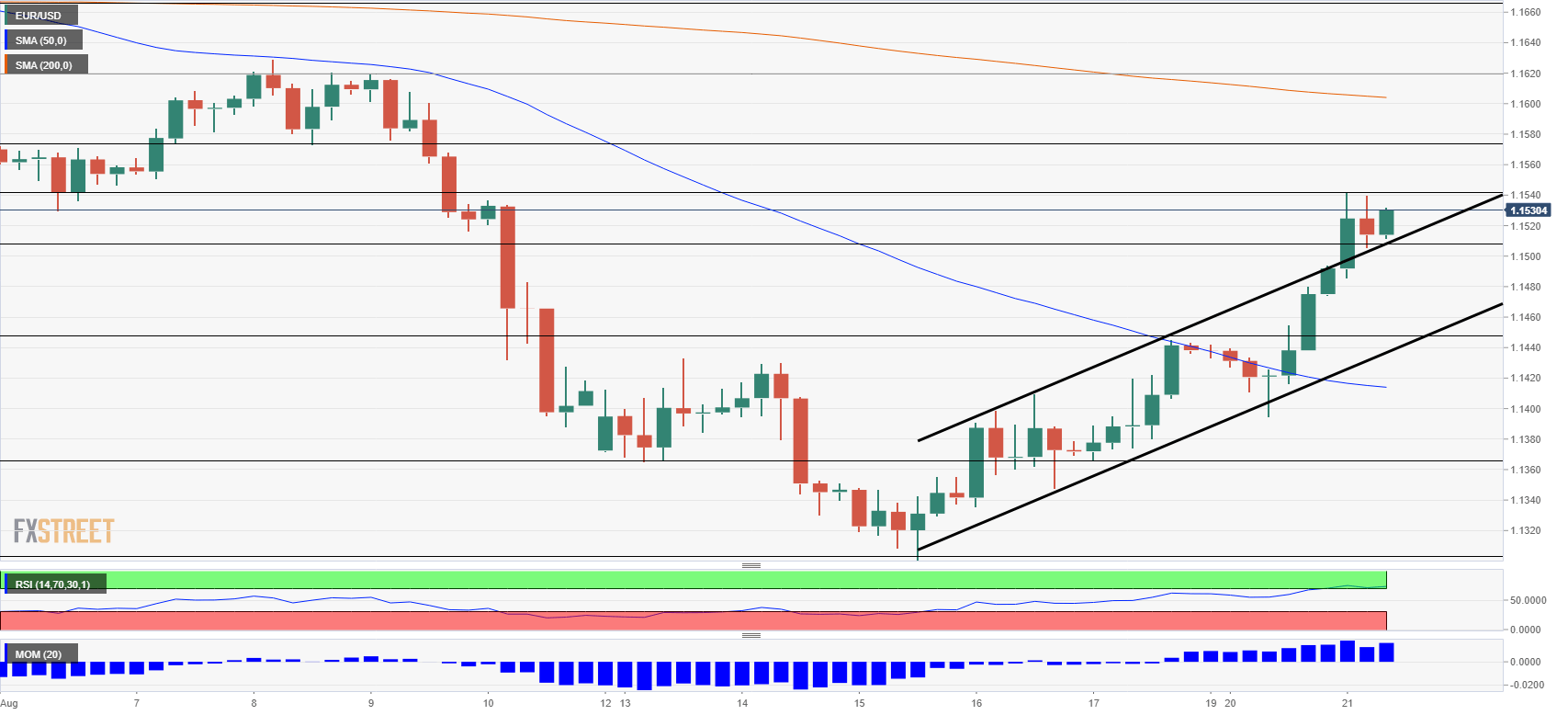

EUR/USD Technical Analysis

The EUR/USD broke above the uptrend channel, a bullish sign. In addition, Momentum is looking robust and the pair made a decisive break above the 50 Simple Moving Average on the four-hour chart. On the other hand, the Relative Strength Index (RSI) is above 70, indicating overbought conditions.

Leave A Comment