On Thursday, the EUR/USD outlook painted a promising picture with a bullish stance, with the dollar’s weakening as a key factor. There is growing optimism regarding the potential peak in US interest rates. This sentiment followed the Federal Reserve’s decision to keep rates unchanged.  Freepik Fed Chair Jerome Powell mentioned the possibility of another rate hike. However, he also stated that the risks of being too aggressive or too cautious were now balanced, with the funds rate target reaching a 22-year high of 5.5%. Consequently, the markets perceive it as a signal to maintain a less than 20% likelihood of a rate increase in December. Meanwhile, ten-year Treasury yields declined by 20 basis points from their highs on Wednesday.IG Markets analyst Tony Sycamore noted the shift in sentiment, saying, “Compared to the previous FOMC meeting, the current stance is more balanced and cautious.” Moreover, traders gained confidence that US interest rates might have peaked when data revealed a significant contraction in US manufacturing in October. Notably, US manufacturing experienced a sharp contraction after showing signs of improvement in prior months, with new orders and employment declining. However, US job openings increased in September, indicating ongoing labor market tightness.Elsewhere, European Central Bank policymakers are reviewing the interest rates offered on government cash deposits, considering a potential reduction. This move is aimed at mitigating the mounting losses resulting from their efforts to combat inflation. EUR/USD key events todayInvestors will receive one key report from the US,

Freepik Fed Chair Jerome Powell mentioned the possibility of another rate hike. However, he also stated that the risks of being too aggressive or too cautious were now balanced, with the funds rate target reaching a 22-year high of 5.5%. Consequently, the markets perceive it as a signal to maintain a less than 20% likelihood of a rate increase in December. Meanwhile, ten-year Treasury yields declined by 20 basis points from their highs on Wednesday.IG Markets analyst Tony Sycamore noted the shift in sentiment, saying, “Compared to the previous FOMC meeting, the current stance is more balanced and cautious.” Moreover, traders gained confidence that US interest rates might have peaked when data revealed a significant contraction in US manufacturing in October. Notably, US manufacturing experienced a sharp contraction after showing signs of improvement in prior months, with new orders and employment declining. However, US job openings increased in September, indicating ongoing labor market tightness.Elsewhere, European Central Bank policymakers are reviewing the interest rates offered on government cash deposits, considering a potential reduction. This move is aimed at mitigating the mounting losses resulting from their efforts to combat inflation. EUR/USD key events todayInvestors will receive one key report from the US,

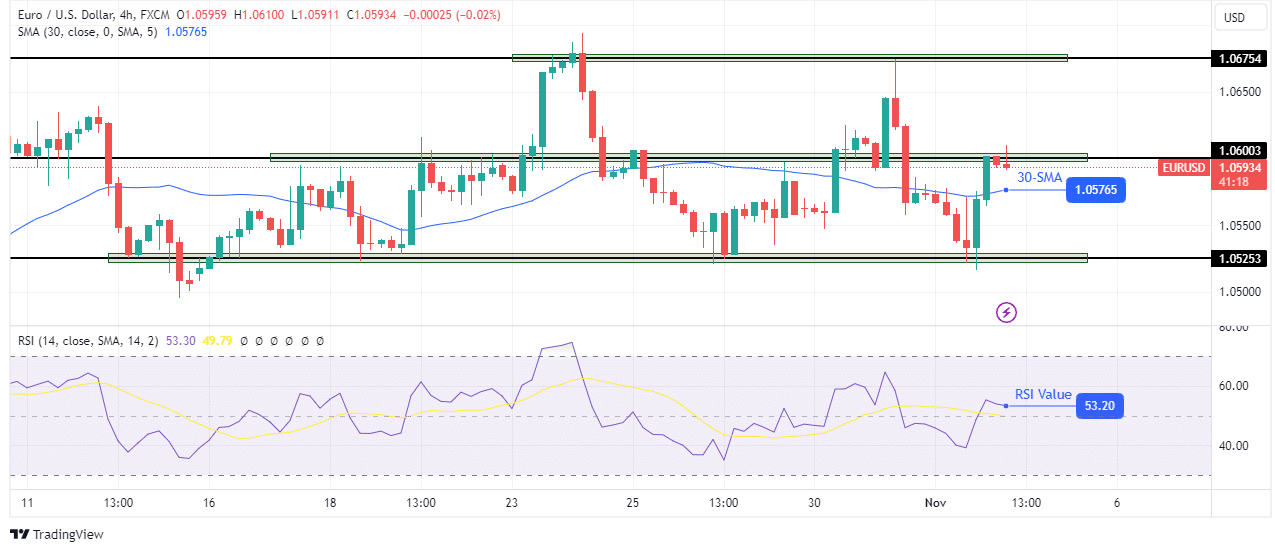

EUR/USD technical outlook: Bulls push for a 1.0600 resistance break. EUR/USD 4-hour chartThe EUR/USD has recovered after finding support at the 1.0525 level. The price still lacks direction as it chops through the 30-SMA. However, on a smaller scale, bulls are in control as the price sits above the SMA and the RSI above 50. This bullish move has paused at the 1.0600 key level. Given the recent choppiness, bears might emerge at this level to push the price down to the 1.0525 support. However, if bulls hold, the price will likely break above the 1.0600 resistance level. It would then likely retest the 1.0675 resistance level.More By This Author:Gold Price At Resistance Under $2,000 Ahead Of The US NFPGold Price Playing In Rising Wedge, Focus On FOMCEUR/USD Price Analysis: Downbeat EU CPI To Weigh On Euro

EUR/USD 4-hour chartThe EUR/USD has recovered after finding support at the 1.0525 level. The price still lacks direction as it chops through the 30-SMA. However, on a smaller scale, bulls are in control as the price sits above the SMA and the RSI above 50. This bullish move has paused at the 1.0600 key level. Given the recent choppiness, bears might emerge at this level to push the price down to the 1.0525 support. However, if bulls hold, the price will likely break above the 1.0600 resistance level. It would then likely retest the 1.0675 resistance level.More By This Author:Gold Price At Resistance Under $2,000 Ahead Of The US NFPGold Price Playing In Rising Wedge, Focus On FOMCEUR/USD Price Analysis: Downbeat EU CPI To Weigh On Euro

Leave A Comment