US existing home sales came out at 5.45 million annualized, slightly above 5.4 million that was expected. In addition, last month’s number was slightly revised to the upside: 5.36 instead of the original report that stated 5.33 million.

While the numbers basically deserve the title “within expectations”, they come on top of a week that has been nice to the US dollar, and provide fuel for last minute gains instead of profit taking.

The Federal Reserve went hawkish by widening the door for a June rate hike. Not only did they mention the word June 6 times in the minutes but also talked about it as a serious option, given some more upbeat data.

The publication provides this positive data. Sales of second hand homes are the lion’s share of transactions but on the other hand they do not trigger the same amount of economic activity that a sale of a new home creates. Nevertheless, good news is good news for the greenback, whether it is coming from a first, second or third tier publication.

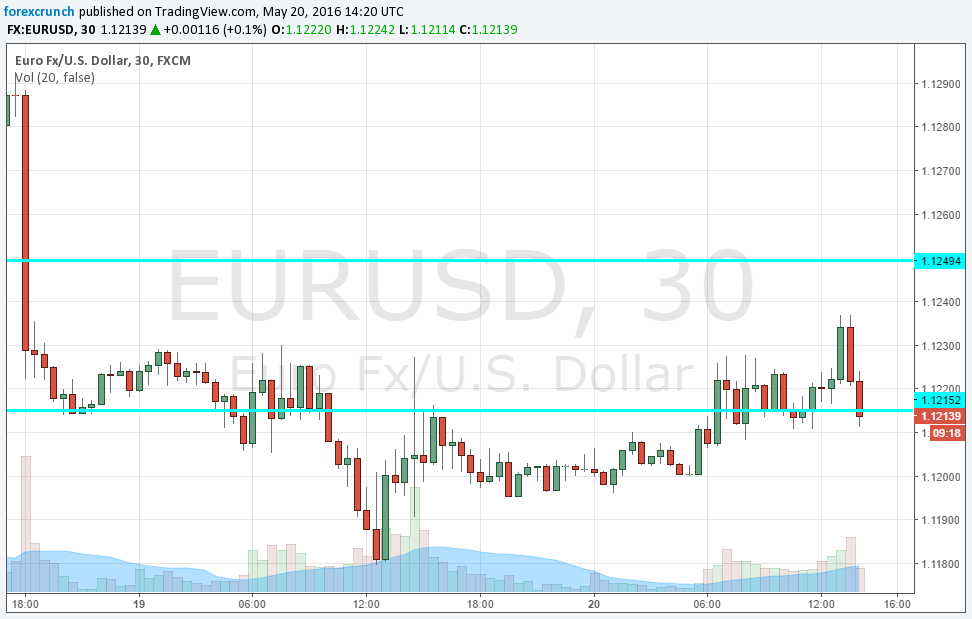

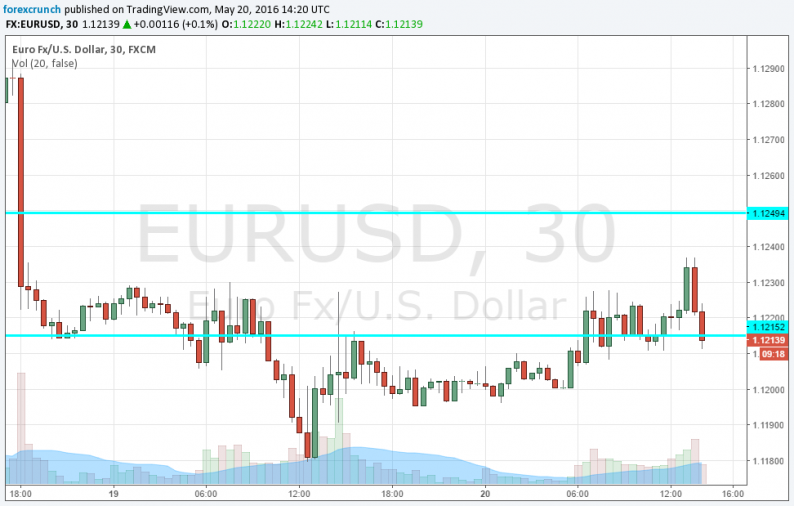

We are seeing EUR/USD drift back down after an attempt to recover. 1.1180 is the next line of support, followed by 1.1150. Resistance awaits at 1.1230 and 1.1335.

Leave A Comment